A new method of payment is on the horizon for American customers. The biggest credit card company in the US, Chase, declared that it would start issuing new Chase Visa credit cards featuring Contactless Payments technology by the end of Q2 2025. As a leading payment provider, this includes co-brand cards. The second half of 2025 will see the addition of contactless payment capabilities to Chase debit cards.

What is a contactless payment?

Contactless payment is a tap-and-go approach that does not require currency. Based on their proximity to the point-of-sale terminal, customers only need to tap their card to finish the transaction at checkout. There is no need to swipe or insert a card.

In recent years, there has been interest in this “wave and pay” payment option. From the perspective of the customer, contactless payment provides a quick and convenient method of payment: Don’t bother lugging along access cash, and don’t waste time typing your pin. Even though five or ten years ago, consumers might have had doubts about the security of contactless payments, knowledge of the technology underlying these payments has helped them gain confidence over time.

Companies benefit as well, experiencing cost-free operational efficiency. Contactless payment protects companies from the charges of fraud while it also improving client pleasure.

Although it is most common in Australia, Canada, South Korea, and the United Kingdom, contactless payment is also becoming more and more widespread in other countries, including the United States. Contactless payment is becoming more and more of a need rather than a luxury as it becomes more and more popular in other nations and as foreign travel resumes after vaccination.

How does contactless payment work?

When a consumer is ready to make a purchase and possesses a credit card that accepts contactless payment methods, what will happen? The consumer merely needs to touch or wave the RFID-embedded card near the Contactless Symbol to utilize a merchant’s card reader instead. The card’s chip sends a signal to the card reader, which then completes the payment.

Contactless payment technology will eliminate the need for customers to use cards exclusively for payments. Phones, watches, fobs, and stickers/labels can all be converted into payment devices using contactless payment technology. For instance, during the 2025 Summer Olympics in Rio de Janeiro, Visa gave rings to forty-five Olympic participants. The athletes were able to make purchases at the Olympic Village thanks to the jewelry’s embedded payment chips. These companies had terminals that used RFID technology called near field communication (NFC).

Contactless payment limits

Countries, payment card companies, and financial institutions all have different contactless payment limits. Contactless payment limits in the United States usually range from $100 to $250 per transaction. Limits, however, can differ and alter depending on the supplier.

Different methods of paying contactless

More retailers are using contactless payments as companies continue to rely on digital procedures. Contactless transactions are accepted by bank ATMs, financial institutions, retail establishments, and dining establishments that have devices with a Wi-Fi sign on their point-of-sale terminals. The two main methods of payment that clients can employ to complete contactless purchases are listed below:

Chip cards: Chip cards are debit or credit cards that use an integrated circuit chip to store data. These cards come in two varieties: those that utilize a chip bearing a digital signature or those that use a chip with a personal identification number (PIN). The type of card you have is usually determined by your bank or card provider, though many retailers accept both.

Contactless payment on phone: Users make mobile payments with an iPhone or Android app that doubles as a digital wallet. Clients can use an authorized smartphone, tablet, or watch to make purchases directly from a wireless connection using these contactless transactions, which do not require a physical card. A digital wallet allows users to upload and select from a wide range of cards.

Pros of contactless card payments

Businesses can gain from using contactless payment mechanisms in the following ways:

Safety : Because chip cards have a small antenna that transmits data to a card reader when a customer inserts it during a transaction, they are safe ways to pay. A token, or one-time code, is then sent from the card to the POS reader to complete the transaction. A fresh code is generated each time a consumer completes a transaction, and this code never reveals the user’s account details.

Preventing fraud: NFC-enabled smart devices help to eradicate fraud because a card reader can only read radio waves from a short distance. Since the information is transmitted from the card to a reader within a small physical distance, there is little chance that any transaction will be halted.

Practicality: If customers have a tap-to-pay smart device and card reader, they can use a secure app that requires two-factor authentication, such as inputting a password, while leaving their credit or debit cards in a wallet. This approach is convenient because users don’t have to use a real card and then put it back in their wallet or handbag. Additionally, when a customer uses a chip card, the tap-to-pay technology eliminates the need to wait for the card to process the transaction after inserting the card into a reader.

Cleanliness: Customers can do transactions with contactless payments without having to speak to someone in person. Whether using self-checkout options or checking out with a cashier, tap-to-pay allows customers to skip punching a pin pad or physically giving their debit or credit card to a cashier. This allows customers to avoid germs.

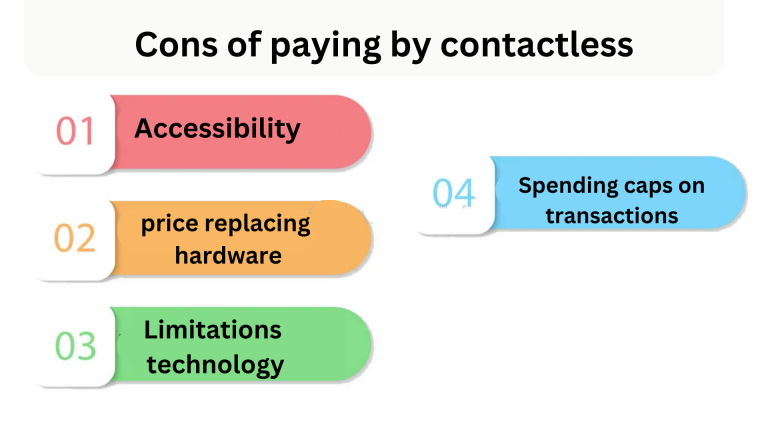

Cons of paying by contactless

The following are some drawbacks that businesses could encounter while introducing contactless payment methods:

Accessibility: Not everyone has access to smart devices or is familiar with how to use them, even if many consumers own modern technology, such as smartphones or cards with tap-to-pay features. For many customers, cash remains the preferred form of payment. As more businesses stop accepting cash payments and more institutions transition to fully mobile access, customers will need to adjust.

The price of replacing obsolete hardware: Even while tap-to-pay is now widely accepted by restaurants and shops, not all establishments accept it. Despite accepting both chip and non-chip cards with a magnetic strip, contactless payment methods are not accepted by the majority of credit and debit card readers. They will need to purchase computer systems and point-of-sale (POS) readers if they choose to use this technology.

Limitations of technology: Although tap-to-pay techniques might be straightforward and useful, technological issues can still occur. For example, a card reader may show a card problem when a customer attempts to complete a payment. In these situations, customers often physically swipe their cards.

Spending caps on transactions: When completing a transaction at a bank or retail location, contactless payment POS terminals do not require a PIN or the buyer’s signature. This may result in fewer transactions since banks regulate the amount of money that individuals can withdraw or spend.Major purchases delay the process because banks sometimes restrict the amount that you can withdraw from your bank account when making a regular withdrawal.

To sum up

By utilizing technology like NFC to provide safe transactions through cards, phones, or smart devices without physical contact, contactless payments provide a rapid, practical, and hygienic substitute for conventional payment methods. Customers can pay with a tap instead of swiping, inserting cards, or entering PINs, which increases productivity for both businesses and customers. Contactless payments have gained popularity worldwide despite initial security concerns, particularly because they fit with a society that is cashless and mobile-friendly. But when more companies use this technology, restrictions like expenditure restraints, accessibility issues, and the expense of updating devices could become problems.

Faqs

What is contactless payment?

Transactions utilizing touch-free technology are referred to as contactless payments. A financial institution’s credit or debit card or another business that accepts contactless payments, such as Apple Pay or Google Pay, can be used for this.

How does contactless payment work?

When a contactless card is tapped near a compatible terminal, the card’s embedded chip sends a secure signal to complete the transaction without the need for swiping or inserting the card.

Are contactless payments secure?

Yes, contactless payments are generally considered secure. Each transaction generates a unique code, which helps prevent fraud, and many contactless cards use EMV chip technology for added security.

How can my contactless credit card be protected?

Like any other debit or credit card, you can take precautions to keep your contactless card safe. You can protect your finances with a variety of credit card security measures. Additionally, to help keep all of your information safer, you may learn more about how to avoid identity theft.

How many times in a day is it possible to use a contactless card?

Like any other debit or credit card, you can use your contactless credit card whenever you want. Because a card is contactless, there is no cap on the number of times you can use it.

What would happen if someone used your contactless card after you lost it?

As soon as you can, you should report your card as lost or stolen. That applies to all cards, contactless or not. According to the Fair Credit Billing Act (FCBA), you are only liable up to $50 for fraudulent credit card charges. But that’s only if the fraudulent charges are investigated and verified. You must report them in order for it to occur.

What devices can be used for contactless payments?

In addition to credit and debit cards, contactless payments can be made using smartphones, smartwatches, and other devices that support mobile wallets like Apple Pay or Google Pay.

What are the transaction limits for contactless payments?

In the U.S., contactless payment limits typically range from $100 to $250 per transaction, though these limits can vary by issuer or merchant.

Can I use my contactless card multiple times in one day?

Yes, you can use your contactless card as many times as you need in a day, provided you stay within your daily spending limit set by your bank.

How do I know if my card supports contactless payments?

Look for the contactless symbol on your card. If you’re unsure, check with your bank or card issuer.