Businesses can collect payments both in-person and online thanks to payment gateways. However, because features and contents vary along with price and transaction fees, selecting the best payment gateway can be difficult. Hills Dot has compiled a list of the top payment gateway comparison for a range of company categories in order to assist. We believe the data we provide will help you choose the best choice for your needs and budget.

What Is A Payment Gateway?

By acting as a virtual middleman, an online payment gateway protects the security of both parties to the financial transaction. Sensitive data , which includes the card number, is protected by the payment gateway once users enter their details of payment, which includes the information of the card.It then sends this encrypted data for authorization to the merchant’s bank. After that, the bank makes the decision to accept or reject the transaction. Only once the modern payment gateway has been approved by the cardholder’s bank are payments finalized.

Popular payment gateways in uk

most popular payment gateways are listed below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment gateway comparison chart

payment gateways comparison are listed below:

Payment Gateway | Pricing | E-commerce Support | Developer Support | Feature Customization | In-house Customer Support | Card Types | Payment Methods |

Stripe | Monthly fee: $0 Per-transaction: 2.9%+$0.30 (U.S.) 3.9%+$0.30 (International) | Yes | No | No Out-of-box solutions only | Yes Starts at $1,800/mo. | All major cards | In-store, online, mobile, phone, credit/debit cards, gift cards, ACH |

Cardknox | Monthly fee: $0-$20 based on plan Per-transaction: from 2.49%+$0.30 Customized rates based on volume/other variables | Yes | Yes Dedicated technical support team | Yes Customized solutions available | Yes No extra charge | All major cards | In-store, online, mobile, phone, credit/debit cards, gift cards, ACH, EBT/eWIC |

Authorize.net | Monthly fee: $25 One-time setup fee: $49 Per-transaction: 2.9%+$0.30 | Yes | No | No | Yes | All major cards | In-store, online, mobile, phone, credit/debit cards, ACH |

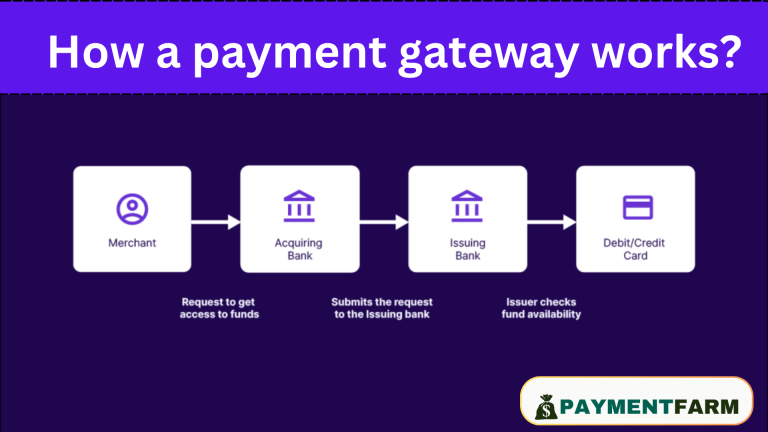

How a payment gateway works?

- A consumer inputs their credit or debit card information on a payment page during the checkout process. The payment gateway either hosts the full payment page or encrypts the entry fields and securely transmits the data to the payment gateway.

- After doing fraud checks and encrypting the cardholder’s information, the payment gateway sends the transaction details and cardholder data to the merchant’s acquirer.

- The acquirer forwards the data to the issuing bank and then to the card scheme (e.g., Visa, Mastercard). The payment is either approved or denied when additional fraud checks are completed.

- The authorization decision returns in the same manner to the payment gateway, where the merchant and consumer are notified if the payment was accepted or denied.

- Depending on the issuing bank’s decision, the payment page will either display the payment confirmation or, in the event that the payment method has been declined, request that the customer try another one.

Pros and Cons of popular payment gateways

Pros

- Safety: Payment gateways carry out fraud checks and secure credit card data. This improves your company’s security and protects customer data.

- Customer experience: Increased client satisfaction and trust can result from a seamless and secure payment process.

- International payments: Many payment gateways handle different currencies, allowing businesses to accept payments in the native currencies of their customers.

- Including:Payments can be automated by integrating payment gateways with a website using APIs or plugins.

- Savings: By combining payments, businesses can save money on overhead and processing expenses.

Cons

- Gateways for self-hosted payments: Setting up and maintaining these gateways requires a high level of technical skill. Additionally, you bear full responsibility for data security and PCI compliance.

- Personalized gateways: Custom gateways might be expensive to develop, but they offer the company complete control over the system.

To sum up

Any business that wants to ensure secure, efficient, and scalable payment processing must choose the right payment gateway. payment gateway comparison that cater to businesses of all sizes, including Worldpay, PayPal, and Stripe, offer a variety of services like flexible integration options, fraud prevention, and support for several currencies. When selecting a gateway, consider factors such as reporting features, compatibility with existing systems, pricing models (subscription versus pay-as-you-go), and the level of customer support provided. Well-known options provide ready-to-use solutions, whereas self-hosted or custom gateways may offer more control but have higher initial costs and more complex technological requirements.

Faqs

How does a payment gateway work?

When a consumer inputs their credit card details into your web form, the payment gateway authorizes payments, validates credit cards, and looks for fraud. As soon as the charge is approved, the payment gateway transfers the money from your customer’s credit card into your merchant account.

What are the fees of payment gateways?

Be sure to check if a payment gateway charges a one-time setup price, a monthly subscription fee, or a fee for each transaction. If you have a per transaction fee (such as 2.9% + $0.30 in the above table), the payment gateway will deduct $2.90 + $.30 from the $100 that a consumer pays you. Consequently, you will receive $96.80.

What is the common methods of payment in uk ? Digital wallets and credit and debit cards The most widely used payment methods are bank transfers, Apple Pay, and Google Pay.

Are there any drawbacks to using a payment gateway?

Some drawbacks include setup complexity, higher costs for custom or self-hosted solutions, and the need for technical skills to maintain a self-hosted gateway.

Can I use a payment gateway for recurring payments?

Yes, many payment gateways support recurring billing for subscription-based businesses, allowing automatic payments for regular transactions such as memberships or services.

How secure are payment gateways?

Payment gateways use encryption and fraud detection systems to ensure secure transactions. They comply with PCI-DSS standards to protect cardholder data and prevent breaches.

What is PCI compliance, and do payment gateways ensure it?

PCI compliance is a set of security standards for handling cardholder data. Payment gateways ensure PCI-DSS compliance by protecting customer information and reducing the risk of data breaches.

How do payment gateway fees impact my business?

Payment gateway fees can impact your profit margin, especially for businesses with high transaction volumes. Choosing a gateway with competitive fees or a model that suits your business can help minimize costs.

What payment methods are supported by most gateways?

Most popular gateways accept major credit and debit cards (Visa, MasterCard, etc.), digital wallets (Apple Pay, Google Pay), bank transfers, and alternative methods like gift cards and ACH payments.

Are payment gateways suitable for small businesses?

Yes, payment gateways are ideal for small businesses as they offer affordable pricing plans, easy integrations, and scalability for growing businesses.