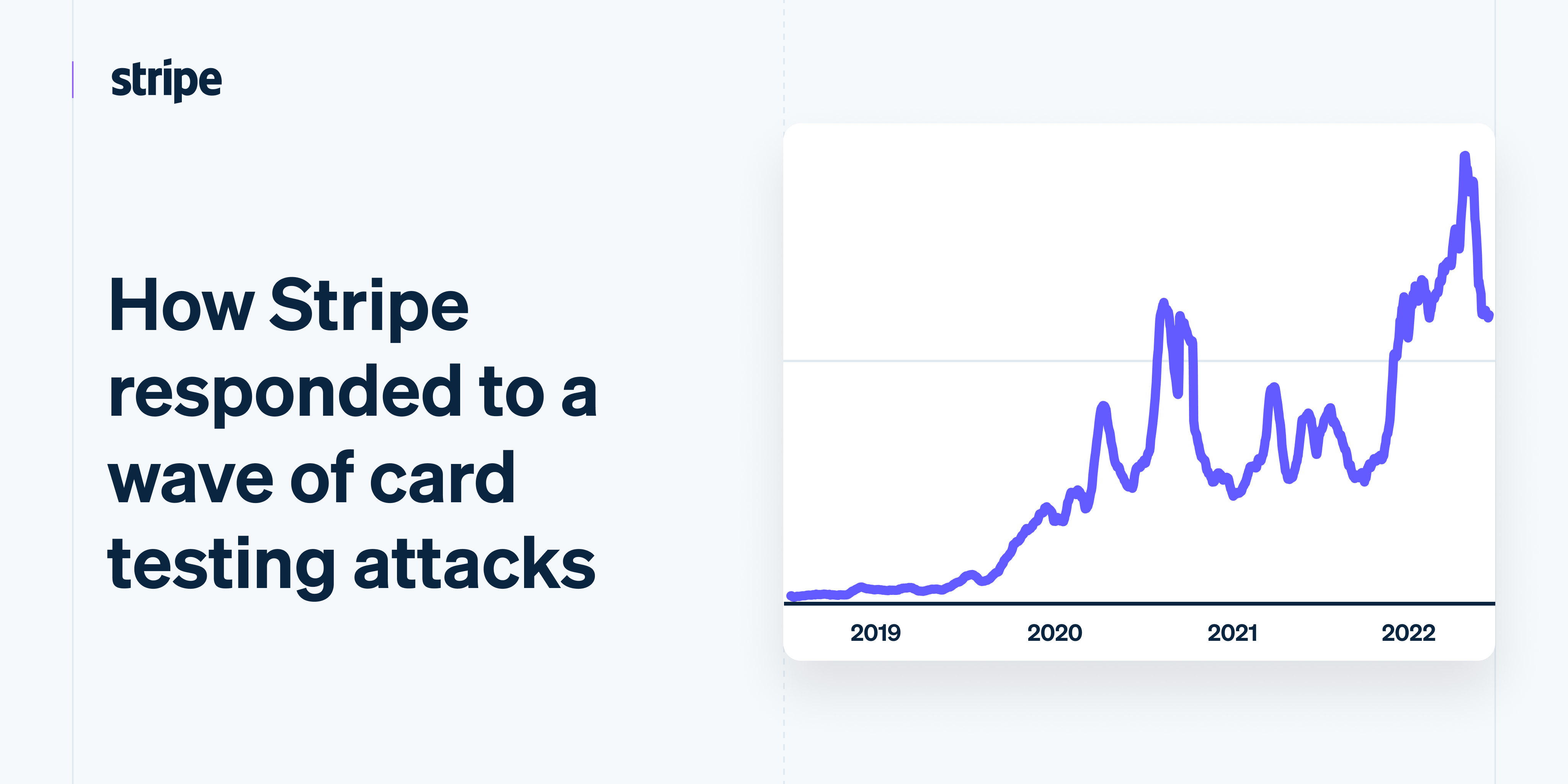

In a world where online payment security is more important than ever, Stripe has made it a point to upgrade its fraud detection algorithms continuously to tackle new threats. Card testing attacks are one of them, in which hackers try to authenticate stolen credit card information by performing low-value transactions. There are monetary losses, chargebacks, and injuries to the reputation of the merchant as a result of these attacks. But the good thing is that Stripe Radar has instituted tight fraud prevention measures that easily manage the threats.

The Rise of Card Testing

To be digital, digital payments have brought a growth in it as a monitoring activity in finding out fraudulent activities. Commonly employed by card bandits, card checking primarily involve use of scripts or automatronbots or emulate tests on thousands of card-informaton stolen online stores in the context of unauthorized transactions. Stripe Radar, which is based on machine learning, has covered the new threat landscape with its intelligent fraud prevention systems blocking fraudulent transactions.

Some Additional Aspects in Anti-Fraud Policy Regarding Stripe Radar

- A Real-Time Reality of Fraud Detection: It would appear that the present anti-fraud solution of Stripe can detect fraud in real-time. With it, organizations and businesses can detect and clamp down on potentially deceitful transactions even before they occur. Using patterns that have a known occurrence in card testing attack patterns, the automated anti-fraud system effectively pre-screen malicious activity.

- The Improvements in the Algorithm for Riskier Evaluation: According to the real-time market analysis of the stripe, risk assessment criteria have been defined algorithmically adjusting with the transaction speed, oddities of location, and behavioral oddity. The exploits do not target the machine itself but the software or the antivirus program which takes special effort while carrying out system scans across an organization. Multiple exploitations of pre-existing weaknesses in application security and bad coding practice for programs occur in the subsequent years.

- Increased Measures in Security and API Protection: Security of Stripe’s API had been reinforced making it harder for automated bots to misuse it. New secure systems within Stripe are seen to yield the goals of more authentication steps which can make payments through certain means be reduced. Combination of multi-factor authentication (MFA) with behavioral biometrics offers an extra level of protection against unauthorized intrusion.

Sophisticated Fraud Response Mechanisms

Fraud payment detection has been improved with Stripe Radar enhancements, enhancing merchants’ ability to easily report suspicious activity.

Stripe anti-fraud tools feature real-time alerts and an enhanced dashboard for merchants to act quickly against fraudulent activity. Predictive analytics driven by machine learning assist companies in predicting fraud patterns before they occur.

How Stripe Radar Protects Against Card Testing

To assist companies in protecting against card testing defence issues, Stripe Radar tactics involve:

- AI-driven transaction fraud detection to reduce false positives and block fraudulent attempts.

- Prevent fraud through credit card testing activities with security measures, in place such as denying repeated transactions duly approved, set risk warnings and the use of Captcha services.

- Toolkits to ensure the security of online transactions include an additional prevention module of 3D security which requires the processing of orders considered risky.

- Also, ensure maximum precaution would include a credit card guarantee some of the grands would use a check payment get reference to its sequence, run Central Reconciliation of credit cards.

Merchant Security Enhancement using Stripe Radar

In addition to flagging fraudulent transactions, Stripe Radar features assist companies by:

- Offering fraud risk management dashboards, enabling enterprises to analyze transaction behavior in depth.

- Setting up real-time alert system so that the merchants can get notified about activity that looks suspicious for example from fraudulent users.

- Offering security measures that help members of the stripe provided platform how to customize anti-fraud checks that are most suitable for their organization.

- Integrating artificial intelligence technology to identify unusual claims making practices which will change as credit card skimmers get smarter.

- Adding chargeback mitigation tools, assisting merchants in effectively disputing fraudulent transactions.

Future Enhancements and Updates

Stripe security updates are always in progress. Currently the firm is developing mechanisms against false play, in order to try to stay ahead of the cyber criminals always incorporating differing methods of attacks. The enhancements that will be part of the Stripe Radar updates will see more detailed fraud prevention options for the corporate clients and their respective clients.

The most forward looking changes include:

- The introduction of highly sophisticated anti fraud models making use of both behavioral analytics and AI to predict probable patterns of fraud recruitment in no time.

- Advanced fraud risk management tools with enhanced transparency into transaction abnormalities.

- Real-time fraud detection enhancements to enable companies to respond promptly against threats.

- Transaction scoring by AI to enable an added level of security so only genuine payments are processed.

- Compliance checks enabled by automation to assist businesses in complying with emerging global payment security standards.

- Expanded data-sharing initiatives that allow businesses to access anonymized fraud trends to strengthen security across industries.

Conclusion

As card testing mitigation continues to be an utmost priority in ecommerce fraud prevention, Stripe Radar performance gets even better through sophisticated fraud response systems. With the use of Stripe security platforms and remaining proactive in fraud prevention tools, companies can strengthen their payment gateway security against new threats. The dedication of Stripe security systems assures a safer, stronger digital commerce environment. By constant innovation, Stripe security updates will keep Streamlining Stripe fraud solutions to make online payments more secure and safeguard companies against losses. Fraud detection algorithms will be even more advanced, providing stronger protection against emerging cyber threats. With the implementation of predictive analytics, automated fraud prevention, and AI-powered detection systems, Stripe Radar is redefining online transaction security. Just as cybercriminals adapt, Stripe’s capability to detect, prevent, and neutralize threats in real-time will also adapt, guaranteeing the integrity of digital transactions for businesses globally.

FAQs

What is Stripe Radar?

Stripe Radar uses machine learning algorithms to detect and block fraudulent transactions in real-time, thus aiding merchants in cutting down on chargebacks and unauthorized payments.

How Stripe Radar is able to detect card testing attacks?

The Radar uses fraud technology algorithms that combine real-time fraud detection and behavioral analytics to understand behavior patterns unusual to the specific transaction under consideration- such as an excessive volume of small transactions in a short period of time and rapid retry attempts.

Can Stripe Radar block fraudulent transactions automatically?

Yes. Stripe Radar has built-in automated fraud prevention features that enable businesses to set up rules for blocking a fraudulent transaction that looks suspicious without manual intervention.

How can businesses strengthen security with Stripe Radar?

Businesses can heighten security by:

- Implementing multi-factor authentication (MFA).

- Using 3D Secure authentication for all high-risk transactions.

- Implementing custom fraud-scoring rules.

- Using fraud analytics dashboards to monitor transaction activity.

What happens if a good transaction is blocked?

If a legitimate transaction is erroneously blocked, the business can reverse the fraud detection rules through the Stripe Radar dashboard and modify the fraud prevention settings accordingly.

Is Stripe Radar a worldwide tool?

Indeed, it encompasses frauds risk management in every corner of the Earth where Stripe has footprint.

How does machine learning increase fraud prevention technology of Stripe Radar?

Machine learning models of Stripe Radar continuously analyze transaction data, learning from previous fraud patterns to better detect fraudulent payments and to mitigate card testing strategies.

What are the costs associated with Stripe Radar?

Stripe Radar is included with Stripe’s pricing plans, but some advanced fraud protection features may incur additional costs. Businesses should always verify security updates and pricing information on Stripe’s site for the latest information.

Can merchants customize their fraud prevention settings?

Yes. Merchants can set up custom fraud rules, change risk thresholds, and turn on specific Stripe security options pertinent to their business needs.