In the modern globalized world, authority payments worldwide are a crucial factor in facilitating financial transactions across borders. Global payment systems are utilized by companies, governments, and banks to facilitate transactions efficiently and securely. Knowledge of global payment processing and cross-border payments becomes necessary to cope with the intricacies of complex financial transactions. As globalism increases, cross-border financial transactions are also on the rise, and with them, so is the need for secure and efficient payment handling. The web-based economy is highly dependent upon

the process of payment sending and receiving smoothly in order to have business move fluidly across international borders. The article delves into the nuances of global payments infrastructure, global payment rules and regulations, and payment security guidelines to create a complete picture of the new global payments landscape.

Understanding Global Payment Gateways and Infrastructure

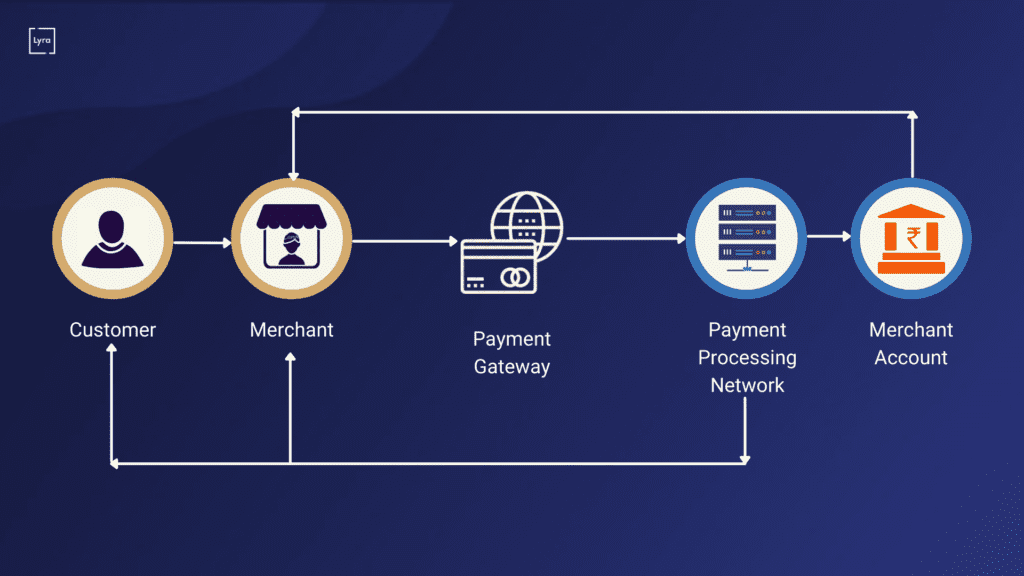

The payment gateway infrastructure of the world is built on a robust global payment infrastructure that allows for seamless payments between nations. Payment gateways are middlemen between banks, merchants, and customers and provide secure and effective payments. Financial institutions are continually improving security and efficiency with rapid advancements in digital payment systems.

Key Elements of Global Payment Gateways

- Merchant Interface: Web sites where businesses add payment facilities to facilitate transactions.

- Acquiring Banks: Banks which make payments on merchants’ behalf.

- Issuing Banks: Banks which issue payment cards and authorize consumers’ transactions.

- Payment Processors: Payment companies which are responsible for handling payments, such as checking for transaction authenticity and making correct funds transfer.

- Security Procedures: Adherence to payment security standards like PCI DSS protects customer data and avoids fraud.

Digital Payment Systems and International Transactions

As technology advances, digital payment systems have gained more prominence so businesses can receive payments from multiple sources, i.e., credit cards, mobile wallets, and cryptocurrencies. The systems make transactions faster, lower processing charges, and offer better security.

Major Global Payment Trends and Processing Charges

Global payment trends point toward increased cashless transactions, with cryptocurrencies and digital wallets taking center stage. Yet, businesses also have to factor in payment processing charges across the globe, which are different depending on transaction type, currency exchange, and service providers. It is important for companies dealing in multiple countries to be aware of these costs.

Trends that Shape Global Payments

- Digital Wallets on the Upsurge: Apple Pay, Google Pay, and PayPal are emerging as the payment avenues of choice for making online transactions.

- Blockchain and Cryptocurrency Usage: Bitcoin and other cryptocurrencies are emerging as alternative ways of making secure global transactions.

- Payment Processing through AI and Machine Learning: These two are enhancing the detection of fraud and increasing security in online transactions.

- Buy Now, Pay Later (BNPL) Services: Consumers are increasingly turning to BNPL services for online purchases, transforming conventional credit models.

- Open Banking Initiatives: Governments across the globe are launching regulations to push banks to exchange financial data securely, which is resulting in competition and innovation in the sector.

Payment Processing Fees Around the Globe

Payment processing fees differ across payment systems by nation and are based on several factors, including:

- Transaction type (domestic or cross-border)

- Currency conversion fees

- Bank charges

- Regulatory requirements

Firms must analyze these costs and choose the most economical authority payment methods to maximize their payment processing plans.

Digital Payment Systems and International Transactions

With the development of technology, digital payment systems have become more prominent so that businesses can accept payments from various sources, i.e., credit cards, mobile wallets, and cryptocurrencies.

Popular Global Online Payment Options

- Credit and Debit Cards: American Express, Mastercard, and Visa continue to be the leaders.

- Mobile Payment Solutions: Apple Pay, Google Pay, and Samsung Pay offer safe and easy payment methods.

- Cryptocurrency Payments: Ethereum and Bitcoin are being adopted by more and more global merchants.

- Bank Transfers and Direct Debit: SEPA in Europe and ACH in the US enable safe bank-to-bank transfers.

- QR Code Payments: Used extensively in China, India, and Southeast Asia, QR codes facilitate smooth digital payments.

Challenges in Payment Processing and Compliance Regulations

In spite of technological progress, some payment processing issues plague business houses and banks. Payment system disparities between nations, exchange rates, and the divergence in requirements at different locations form barriers for transactions abroad. Being compliant with global payment regulation and global payment compliance is the key to prevention of legal liabilities and maintaining operational flow.

Challenges Faced in Payment Processing

- Regulatory Complexity: Various nations have special requirements for compliance that a business must follow.

- Security Risks and Fraud: Payment systems are a target for cybercriminals, so security is an essential aspect.

- Currency Exchange Fluctuations: Unpredictable exchange rates can affect cross-border transactions.

- High Transaction Fees: Differing fees can be a major factor that affects the profitability for international businesses.

- Integration Issues: Companies usually encounter challenges integrating multiple payment systems into their platforms.

Ensuring Payment Security and Fraud Prevention

In spite of the advancement in digital payments, compliance with payment security guidelines is a given. Companies should abide by rules for payment processing and adopt secure payment fraud protection globally to maintain customer information as well as block fraudulent transactions.

Best Practices in Payment Security

- Implement Two-Factor Authentication (2FA) to ensure added security.

- Use Secure Encryption Solutions to protect personal information.

- Routine Security Audits to track payment systems vulnerabilities.

- Compliance with PCI DSS to ensure effective payment processing.

- AI-based Fraud Detection to detect suspicious behavior in real-time.

Payment Authorization and Settlement Processes

The payment authorization processes make sure that transactions are authorized on the basis of security and compliance verifications. Effective payment settlement systems are required to settle transactions in a timely manner. The processes differ from region to region based on financial regulations and levels of technology adoption.

Key Features of Payment Settlement Systems

- Real-time settlement systems: Improved processing and shorter waiting times.

- Clearing and reconciliation processes: Accuracy of fund transfers.

- Automated dispute resolution: Effective chargeback and payment dispute management.

Emerging Technology and Payment APIs

Trends in payments like blockchain, machine learning, and artificial intelligence are integrated to revolutionize the industry. Payment APIs are utilized by businesses for cross-border payments to automate, screen for compliance, and facilitate easy cross-border payments.

How APIs Enhance Payment Processing

- Simple integration with e-commerce platforms.

- Real-time monitoring of transactions to prevent fraud.

- Automated currency exchange for cross-border transactions.

- Security of data boosted via tokenization.

Conclusion:

The global payment sector is certainly not static – there is technology and regulation driving changes in our very process of conducting commerce. There is an imperative for business entities to be perfectly in tune with payment trends to remain competitive and compliant. From current trends, it appears that cross-border payments in the future would be more secured, instant, and with better access to online payment platforms. By knowing the complexities of authority payments all over the world and adopting new payment technologies, organizations and banks can glide in a way that is smooth and efficient through the world economy.

FAQs

What are global authority payments?

Global authority payments refer to transactions subjected to the judicial authority of more than one jurisdiction with strict compliance and security standards here to ease trans border transactions.

How do international payment systems work?

International payment systems facilitate peer-to-peer transactions, linking banks, merchants, and consumers with secure payment gateways and processors.

What are the main issues in international payment processing?

Regulatory compliance, security risks, exchange rate volatility of currencies, exorbitant payment processing fees, and integration issues are the major challenges.

How can businesses reduce payment processing fees around the world?

Cost minimization is possible by selection of low-cost payment mechanisms, negotiation of fees with service providers, and management of currency exchange.

What online payments are suitable for cross-border transactions?

Credit cards, digital wallets, cryptocurrency Global Payment Gateways, bank transfer, and QR code payments are widely used.

How are cross-border transactions secured by payment security standards?

Transactions are secured from cyber attacks and fraud by security standards such as PCI DSS, two-factor authentication, and encryption technology.

What is the international transactions role of payment APIs?

Global Payment Gateways APIs facilitate the integration of payment systems, automate compliance testing, and support real-time monitoring of transactions.

How does currency exchange impact cross-border payments?

Exchange rate movement can have an effect on the cost of a transaction, and therefore, companies need to incorporate hedging arrangements or use multi-currency accounts.

What are the current Global Payment Gateways trends worldwide?

The current trends are the increased use of digital wallets, blockchain payments, artificial intelligence-based fraud prevention, open banking projects, and real-time Global Payment Gateways.

How do companies become compliant with cross-border payment rules?

The companies have to remain current on international regulatory developments, deploy compliance Global Payment Gateways, and engage with authorized payment processors.