In today’s fast-paced digital economy, B2B transactions are becoming more dynamic, more global, and more technologically advanced. Whether you run a wholesale business, SaaS platform, manufacturing company, logistics service, or enterprise supply chain operation, having the right B2B merchant accounts and B2B payment solutions is key to improving cash flow, reducing operational headaches, and scaling smoothly.

This guide explains everything you need to know about modern B2B payment processing, merchant services, gateways, and the best digital payment solutions designed for business-to-business transactions.

What Are B2B Merchant Accounts?

A B2B merchant account is a specialized business account that allows companies to accept digital payments from other businesses. Unlike standard retail merchant accounts, B2B accounts support:

- High-volume transactions

- Larger average ticket sizes

- Recurring invoicing

- Custom credit terms

- Automated Level 2 and Level 3 data processing

- International and multi-currency payments

Because B2B transactions often involve substantial amounts, providers typically offer lower interchange rates when Level 3 data is transmitted, helping businesses save money on processing fees.

Why B2B Merchant Accounts Matter

- Faster payment collections

- Improved financial tracking

- Reduced manual invoice processing

- Enhanced security and fraud protection

- Better control of payment workflows

Today, B2B businesses prefer digital payments over traditional methods like checks or cash because they are faster, safer, and easier to manage.

Understanding B2B Payment Solutions

B2B payment solutions refer to the tools and technologies that enable businesses to send and receive payments securely and efficiently. These solutions include:

- Payment gateways

- Virtual terminals

- Invoicing tools

- ACH payments

- Wire transfers

- Digital wallets

- Automated payment scheduling

The right B2B payment solutions can transform how a business handles cash flow, reduces payment delays, and improves customer relationships.

How B2B Payment Processing Works

B2B payment processing involves multiple steps, from initiating a transaction to depositing funds in the merchant’s bank account. The process typically includes:

- Business A (buyer) initiates a payment

- Payment gateway encrypts and sends data

- Payment processor routes the transaction

- Issuing bank verifies the payment

- The payment is approved or declined

- Funds are settled into the merchant account

This entire workflow enables smooth, secure, and compliant payment operations.

Types of B2B Payment Processing Methods

Modern B2B organizations use various digital methods, including:

- ACH Payments – low cost, widely used for invoices

- Credit & Debit Cards – fast and globally accepted

- Wire Transfers – ideal for international payments

- Online payment solutions – good for recurring or subscription-based models

- Digital payment solutions – mobile payments, virtual cards, and more

Businesses usually combine multiple methods to provide flexibility to their clients.

Top Benefits of Using B2B Payment Processing Solutions

1. Faster Payments

Digital systems help you collect payments within seconds instead of waiting weeks for checks.

2. Lower Operational Costs

Automation reduces manual invoicing, data entry, and reconciliation.

3. Better Security and Compliance

B2B payment gateways include:

- Tokenization

- Encryption

- Fraud detection

- PCI compliance

- 2-factor authentication

This strengthens business security and lowers risks of fraud.

4. Easier International Transactions

Cross-border payments become smoother with multi-currency support and global settlement capabilities.

Choosing the Right B2B Merchant Services

The quality of your B2B merchant services can significantly impact your business operations. Merchant service providers offer:

- Payment terminals

- Online payment solutions

- Invoicing tools

- Recurring billing

- Chargeback management

- Reporting dashboards

- Payment integrations

When selecting a provider, evaluate:

✔ Transaction fees

✔ Currency support

✔ Security features

✔ Integration with ERP or accounting tools

✔ Customer support quality

✔ Scalability for future growth

A strong B2B merchant services provider helps your business operate smoothly while maintaining financial transparency.

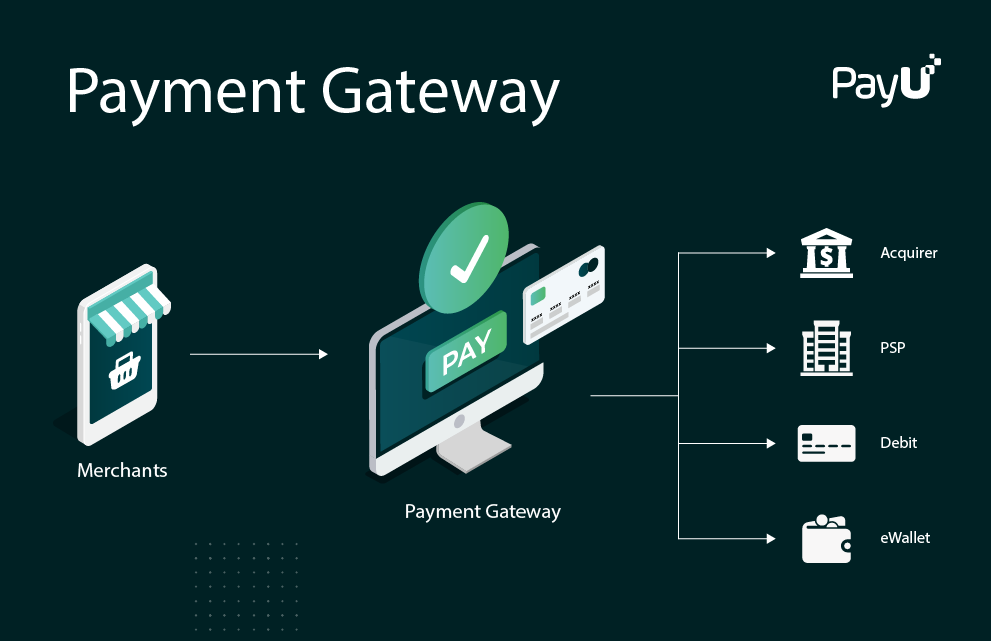

B2B Payment Gateway: The Engine Behind Online Transactions

A B2B payment gateway is the technology that connects a business’s website or invoicing system to the payment processor. It securely sends transaction data and authorizes payments in real time.

Key Features of a Good B2B Payment Gateway

- High-level encryption

- Level 2 & Level 3 data support

- Recurring billing

- Multi-currency capabilities

- Fraud detection tools

- Faster settlement times

- API integrations

Unlike retail gateways, B2B gateways are optimized for high-ticket and invoice-based transactions.

Many companies integrate their payment gateway with ERP platforms like:

- SAP

- Oracle

- QuickBooks

- Zoho

- NetSuite

This ensures smooth financial reporting and automated reconciliation.

Why Businesses Need Digital and Online Payment Solutions

Digital transformation has changed how businesses operate. More companies are shifting toward:

- Online payment solutions

- Digital payment solutions

- Cloud-based invoicing tools

- Automated billing solutions

These tools make payments faster, safer, and more transparent.

Advantages of Online Payment Solutions in B2B

- Clients can pay invoices online instantly

- Reduces paperwork and manual processing

- Improves customer experience

- Supports subscription and recurring billing

- Enhances cash-flow visibility

With the growing demand for fast payments, businesses must adopt digital systems that can scale as they grow.

Best Payment Solutions for B2B Businesses

If you’re searching for the best payment solutions for your B2B business, here are the top features to look for:

1. Multi-Channel Payment Options

✔ Credit/debit cards

✔ ACH

✔ Digital wallets

✔ Online invoicing

✔ Virtual card payments

Multi-channel support increases payment acceptance and reduces delays.

2. Level 2 & Level 3 Processing

This advanced data submission lowers interchange fees and saves businesses money.

3. Global Payment Support

Essential for businesses with international clients or suppliers.

4. API-Driven Integrations

Modern APIs allow your payment system to connect with:

- CRM platforms

- ERP systems

- Accounting software

- E-commerce platforms

5. Strong Security Protocols

PCI DSS compliance, tokenization, and encrypted transactions help prevent fraud.

Payment Processing Solutions for Growing B2B Companies

The demand for scalable payment processing solutions is increasing as businesses expand globally and move into more digital operations.

Here’s what modern payment processing solutions offer:

- Real-time payment tracking

- Automated reconciliation

- Advanced analytics

- Custom payment terms

- Subscription billing

- Multi-currency support

- Faster B2B settlement times

Whether you’re a startup or an enterprise, choosing the right system helps streamline your financial workflow and minimize errors.

How to Choose the Best B2B Payment Solution for Your Business

When evaluating providers, consider these factors:

1. Transaction Fees and Cost Structure

Look for competitive pricing and reduced B2B interchange with Level 2/3 data.

2. Integration with Your Current Systems

ERP and accounting integration is essential for seamless operations.

3. Payment Speed

Faster settlement means better cash flow.

4. Scalability

Choose a solution that grows with your business size and transaction volumes.

5. Customer Support

Available 24/7 support ensures smooth payment operations without downtime

Future Trends in B2B Payment Solutions

The B2B payment industry continues to evolve rapidly. Trends include:

- AI-powered fraud detection

- Blockchain-based settlements

- Instant payments

- Virtual commercial cards

- Cross-border digital wallets

- Automated smart invoicing

Businesses adopting modern payment systems will stay ahead of the competition and maintain strong financial health.

Final Thoughts

The world of B2B merchant accounts, B2B payment solutions, and B2B payment processing is transforming faster than ever. With increasing demand for automation, security, and global connectivity, businesses must use reliable digital and online payment solutions to stay competitive. Whether you’re looking for the best payment solutions or advanced payment processing solutions, selecting the right provider can significantly improve cash flow, reduce costs, and streamline your entire financial operations. By understanding the tools, technologies, and strategies available, you can build a payment system that supports both your current needs and future growth.