In today’s rapid-paced economic landscape, organizations are constantly seeking out ways to streamline operations, save time, and decrease administrative overhead. One of the simplest approaches to do that is by using implementing Batch Payment Processing. This method allows businesses to group multiple payments into one single transaction batch, simplifying both payment execution and reconciliation. By leveraging batch payment processing, companies can significantly reduce manual errors and improve financial efficiency.

Whether you’re a small business owner dealing with payroll or an accountant handling seller bills via Xero batch payments, information batch price processing is critical to optimize your coins flow structures. In this complete guide, we’ll explore everything you need to recognize about batch payments, together with how they paintings, their benefits, commonplace use cases, and gear that guide them.

What is Batch Payment Processing?

Batch fee processing refers back to the practice of grouping multiple financial transactions and filing them collectively in a unmarried method. Instead of initiating every fee one by one, corporations can combine them into a fee batch, that’s processed as one unit.

This method is normally used for:

- Employee payroll

- Supplier/seller bills

- Recurring transactions

- Credit card batch processing

The primary motive of batching transactions is to save time, reduce charges, and decorate accuracy. Whether you are coping with batch transactions, batch assessments, or batch credit card processing, the idea stays the same technique payments collectively rather than personally.

What is a Batch Payment?

A batch payment is a single coaching in your financial institution or price processor to send out more than one bills without delay. Each man or woman payment inside the batch fee still is going to its respective recipient, however they may be handled together, making the system extra green.

Batch Payment Meaning

The batch fee that means is largely a bulk transaction that simplifies debts payable. Instead of processing a hundred invoices one at a time, you could create one batch transaction containing all 100 and authorize them collectively.

What Are Batch Payments?

Batch bills are more than one bills grouped together for processing as a single action. Businesses use batch bills to:

- Automate dealer bills

- Streamline payroll processing

- Improve recordkeeping

- Save on banking or transaction charges

Some of the not unusual gear that support batch bills consist of accounting software program like Xero, ERP structures, and on line banking portals.

Examples of Batch Payment

Let’s say a business needs to pay 25 carriers at the cease of the month. Instead of manually getting into each charge, the finance group creates a batch charge file the use of their accounting gadget. The file consists of payment details like:

- Vendor names

- Account numbers

- Payment quantities

- Invoice references

Once compiled, this payment batch is uploaded to the financial institution or fee processor for execution.

That is a batch payment example demonstrating how this system can lessen manual paintings and blunders quotes.

What is a Batch Check?

A batch check is a published or virtual organization of exams which might be issued collectively as part of a charge batch. For businesses still using paper exams, batch tests allow printing dozens or masses of exams in a single run, making it more practicable to ship out payments.

How Batching Transactions Improves Efficiency

Batching transactions offers several operational benefits:

- Time Efficiency: Instead of spending time on each transaction, batch transactions reduce the workload considerably via managing many at once.

- Lower Costs: Banks and processors regularly rate decrease expenses for batch fee processing in comparison to individual transactions.

- Fewer Errors: Grouping transactions into fee batches enables keep consistency, reduces information entry mistakes, and makes it easier to hit upon anomalies.

Understanding a Transaction Batch

A transaction batch is a collection of economic transactions grouped together for processing. It could involve:

Salary payments

Vendor invoices

Utility payments

Batched charge thru playing cards

The batch may also consist of ACH bills, twine transfers, or credit card batch fees.

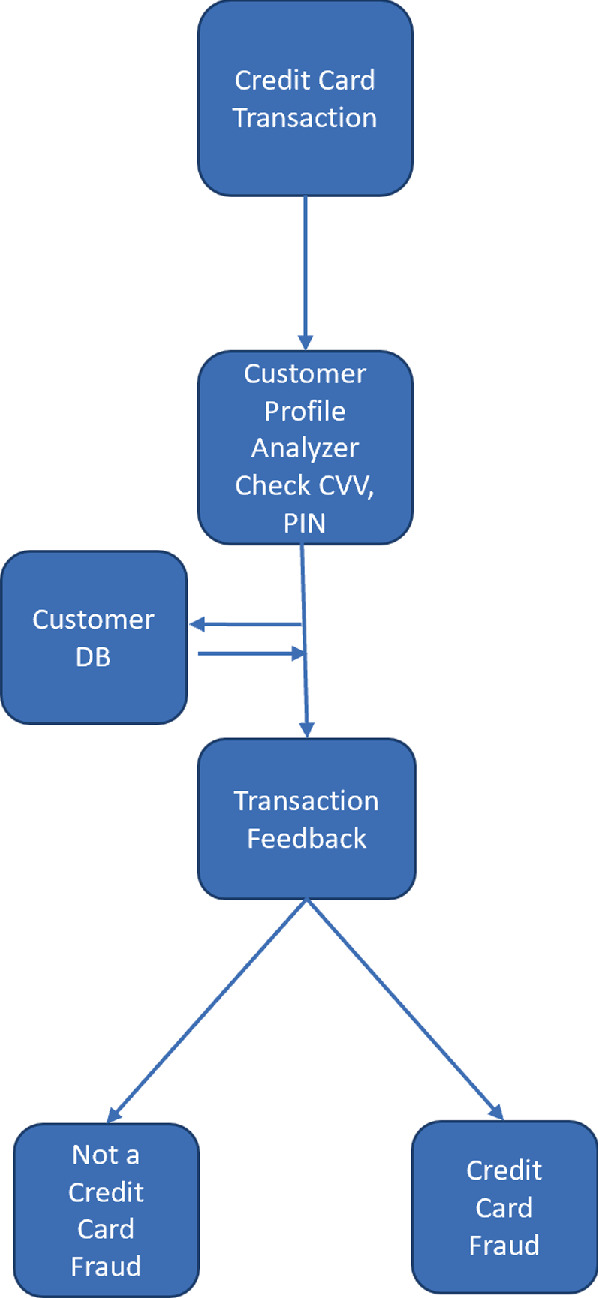

What is Credit Card Batch Processing?

Credit card batch processing is utilized by traders to method multiple card transactions at once. When a commercial enterprise accepts credit card bills all through the day, these are stored in a credit card batch.

At the quit of the day, the credit card batch is submitted to the price processor. This technique ensures that:

- All card transactions are settled

- Funds are transferred to the service provider’s account

- Processing expenses are consolidated

This every day credit card batch machine is critical for retail and eCommerce companies.

Batch Processing for Credit Card Transactions

With batch credit score card processing, all transactions accumulated in a day are accepted and settled in one move. This reduces the range of individual settlements and frequently ends in:

- Faster processing times

- Reduced blunders charges

- Simpler reconciliation

Benefits of Batch Payments

Here’s a breakdown of why corporations decide upon batch bills:

Benefit | Description |

Efficiency | Grouping payments saves time. |

Lower fees | Bulk transactions often cost less. |

Reduced errors | Less manual entry means fewer mistakes. |

Simplified reconciliation | Easy to match records and reconcile accounts. |

Scalability | Works well for companies of all sizes. |

When to Use Batch Payments

You need to consider batch bills when:

- Making payroll bills

- Paying more than one providers

- Handling subscription fees

- Reimbursing more than one employees

If your commercial enterprise offers with repetitive transactions, batch payment processing is right.

Batch Payments in Accounting and ERP Systems

Many accounting and ERP structures encompass batch charge functionality. Some systems offer advanced batching manner features such as:

- Payment scheduling

- Automated approval workflows

- Real-time repute updates

- Audit trails

Popular structures with integrated batch payments capabilities consist of:

- Xero

- QuickBooks

- Sage

- Oracle NetSuite

- SAP

Risks and How to Manage Them

While batch bills are green, they’re not without risks. Common troubles consist of:

- Incorrect recipient info

- Duplicated entries

- Delay in submission of a transaction batch

- To mitigate these, corporations need to:

- Use automated validation tools

- Conduct normal audits

- Set up approval workflows

- Use reconciliation functions in software program like Xero

Conclusion:

In a world where time is money, Batch Payment Processing is an essential device for any business handling a couple of transactions. From credit card batch processing to automated Xero batch bills, this gadget gives pace, accuracy, and control. Whether you’re seeking to automate payroll, streamline vendor bills, or reduce transaction prices, imposing batch payments may be a recreation-changer. By using the proper equipment and following excellent practices, your commercial enterprise can revel in faster workflows, reduced overhead, and improved monetary oversight. Understanding the batching procedure and integrating batch payment answers into your operations might be one of the smartest monetary choices you are making.

FAQs

What is batch payment processing?

Batch payment processing is a method that allows agencies to system more than one payments collectively as a group or transaction batch. Instead of sending every charge in my opinion, you could integrate them right into a fee batch, saving time and lowering administrative effort.

What is a batch payment?

A batch charge is a unmarried instruction to procedure multiple payments at once. For instance, a organization may make a batch charge to pay all its providers at the quit of the month, instead of doing each charge separately.

What are batch payments?

Batch payments seek advice from multiple character bills which might be grouped together and processed as a unmarried batch transaction. They’re usually used for payroll, vendor bills, and routine payments.

What is a batched fee?

A batched price is an character price covered inside a batch payment. Although processed collectively, every batched charge is recorded separately to your economic information.

What is a batch check?

A batch check refers to a couple of exams which might be generated and published or processed collectively as part of a fee batch. It’s beneficial for companies that still depend on physical assessments for payments.

What does batch bills that means seek advice from?

The batch payments meaning is the concept of consolidating a couple of payments into one collective technique. This helps with performance, reduces errors, and simplifies reconciliation.

What is the batching system in payments?

The batching process in bills involves selecting more than one transactions, grouping them, and submitting them to the financial institution or processor together. This is typically supported in accounting software and ERP systems.

Can you provide a batch price instance?

Yes. Imagine a business desires to pay 10 contractors. Instead of creating 10 separate transactions, they devise one batch payment record with all information. This is uploaded to the bank, which then will pay all 10 in a single pass. This is a simple batch fee example.

What is a price batch?

A charge batch is the gathering of transactions submitted together at some stage in batch charge processing. It incorporates all of the necessary facts for the bank or payment issuer to manner every fee.

Are batch bills supported in Xero?

Yes, Xero batch bills permit you to create and manipulate batch payments in Xero. You can choose bills to pay, generate a batch charge document, and upload it in your financial institution. Batch payments Xero capabilities include clean reconciliation and clean audit trails.

How does batch charge in Xero work?

To create a batch price in Xero, go to “Bills to Pay,” select the payments, and click “Make Payment.” Choose the batch fee alternative, generate the report, and ship it in your financial institution. The batch fee Xero gadget simplifies bulk bills.

What is credit score card batch processing?

Credit card batch processing is when a merchant collects all credit card transactions for the day and submits them in a credit card batch to the processor. This guarantees that funds from a couple of transactions are settled collectively.