Choosing the Best Payment Terminal has emerged as one of the most important aspects for smooth transactions and customer satisfaction culture in the fast-moving retail and service sectors. Business houses have many options; therefore, several aspects need to be evaluated to find the best solution to their needs. We have explored the considerations that will determine the best fit and the current trends in the best payment solution and POS systems in Europe.

Best Payment Terminal Options

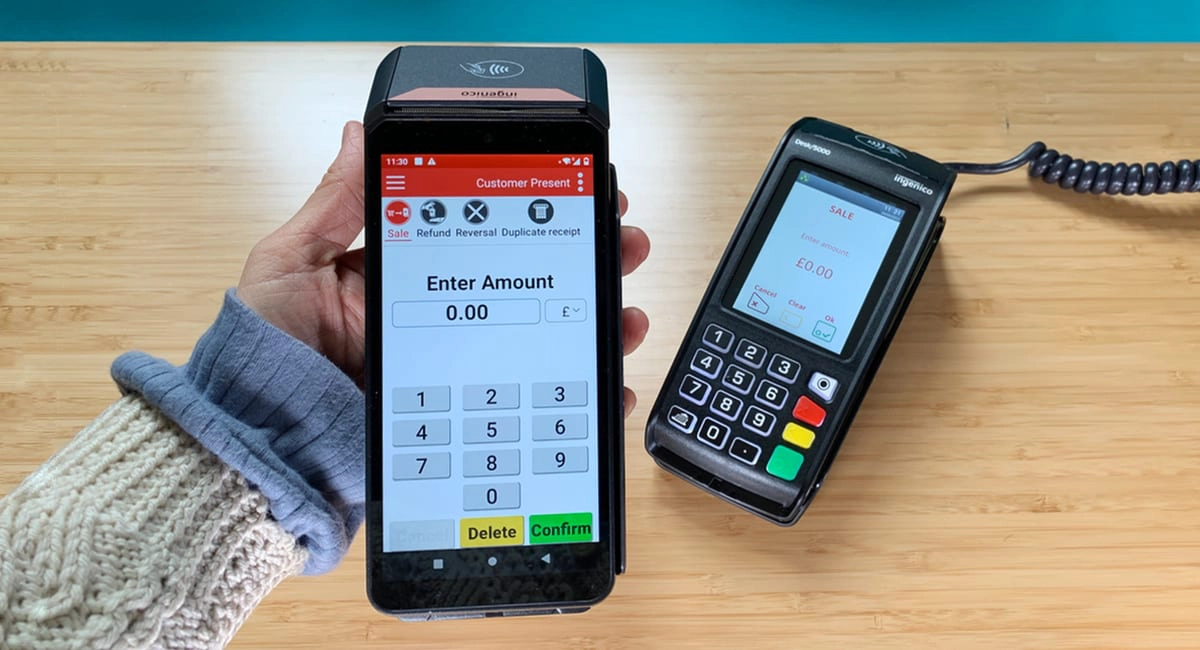

They are developed in several features and functionalities to offer various business solutions, starting from mobile card readers for businesses up to contactless payment terminals, and EMV compliant card machines to every type of business.

The Major Categories of Payment Terminals

Chip and PIN machines are used by retailers; it is used for secure payments of cards.

- Wireless payment terminals: This would be the ideal for mobility use in restaurants or taxi services. Portable card readers for merchants. They are quite suitable for marketplaces and pop-up shops.

- NFC enabled payment devices: Support fast and contactless transactions.

- Unattended payment terminals Europe: Used in parking kiosks and vending machines.

Integrated POS Solutions and Features

In many European businesses, there is always a need to integrate POS solutions that can help them manage payments, inventory, and customer data in an easy and effective manner. Among the variants, cloud-based POS systems and Android-based POS systems are popular because of their flexibility and ease of use.

- Touchscreen POS terminals: Improve customer experience and also speed.

- Multi-currency payment terminals: For businesses with an international customer base.

- Secure transaction processing devices: Serves as data protection and compliance with PCI standards.

- Bluetooth card payment readers: Offers the facility to carry out wireless payments.

Consider Industry-Specific Needs

Every business is different, and the selection of a payment terminal is often dependent on the industry involved.

- Retail POS hardware Europe: Retail POS hardware Europe is focused on very fast transaction processing devices with an inventory integration feature.

- Hospitality POS systems Europe: Hospitality POS systems Europe are user-friendly with split-bill options.

- Restaurant payment terminals: Would have to tolerate tips, tickets, and managing tables.

- Cab card payment machine: Must have compact and mobility-friendly designs

- Self-service kiosk payment systems: Best to be used on unattended stores like vending and parking terminals.

Affordability and Customization

Small businesses and startups tend to focus on affordability without losing functionality. Affordable card machines for payment and simple POS systems can be found for vendors who need to be on a budget. Furthermore, POS solutions can be tailored to individual needs, which means extra long-term value.

Trends on Payment Terminals

- Retailer Cloud POS: Flexible and managed remotely.

- QR code payment systems: Instant electronic payment without a physical card.

- Business smart card readers: Advanced technologies for smooth transactions

- E-commerce payment gateways Europe: Integrated solutions for e-commerce store and sales

Security and Compliance

Data security is of utmost importance. To further protect customer information, a business should select PCI compliant payment systems and secure payment terminals. Other important features are high volume payment terminals and strong payment terminals, especially for those businesses processing thousands of transactions on a daily basis.

Selecting the Right Provider

When selecting a provider, reliability, support, and scalability are some of the things to consider. The leading payment terminal providers in Europe can offer a range of solutions, starting from affordable POS terminals in Europe to advanced payment terminal features tailored for any industry.

Conclusion

To select the very best payment terminal for your venture, you’d need to study your operational needs along with your available budget and future directions. Whether to choose mobile point-of-sale devices for vendors, or integrated POS solutions Europe is the right perspective for focusing all the right and latest features while staying ahead with the trends which would keep up your business’ competitiveness. Offering the most seamless yet secure payment experience from the latest technologies offered in cloud-based point-of-sale and NFC-enabled payments.

FAQs

What is a payment terminal?

A payment terminal is any hardware designed to securely enable businesses to accept card payments, including chip and PIN, contactless, and mobile payments.

How can I choose a suitable payment terminal for my business?

Think about the kind of business you run, the volume of transactions, and your specific needs, for example, whether you need NFC-enabled payment devices or multi-currency payment terminals.

Are payment terminals secure?

Yes, payment terminals of modern times are provided with the necessary security measures: PCI compliance, EMV standards, and others in order to safeguard the data of customers.

What advantages does a cloud-based POS system have?

Remote management, data access in real time, and flawless integration with other business tools, for example.

Does a payment terminal allow international payments?

Yes, using multi-currency payment terminals or e-commerce payment gateways Europe, it is possible to accept payments from international customers with ease.

Are there products that are small business affordable?

Yes, there are many affordable card payment machines and POS systems that appeal specifically to small businesses and startups.

What types of businesses really benefit from a portable card reader?

Businesses with hospitality, food trucks, markets, and taxis benefit especially well from portable card readers due to their mobility and convenience.

How will I know I am in compliance with payment regulations?

Select PCI compliant payment systems and engage reputable payment terminal providers Europe to ensure your system is up to the regulatory standards.

How do chip and PIN machines compare to contactless terminals?

Chip and PIN terminals require customers to authenticate using a PIN, while the contactless terminals just tap their cards or devices and make a transaction.

Can I adjust my POS software?

Most companies that provide the POS will also offer flexible versions that you might be able to customize to work for your specific business, sometimes adding in functions such as inventory, reporting and even customer management.