The phrase “Escrow payment” is probably familiar to everyone who has ever purchased a home, but its meaning extends well beyond the real estate industry. Escrow Online Payment are essentially a kind of legal holding account for money or assets that won’t be released until specific requirements are fulfilled. A neutral third party holds the escrow and releases it either upon the fulfillment of those predetermined contractual obligations or upon receipt of the proper instruction. Escrow serves as a crucial safety net for both sides,

acting as a compromise until both are pleased and a deal may proceed. It makes perfect sense in a business-to-business setting since it guarantees that both companies are happy with a big transaction before the trigger is pulled and the money or assets are moved.b

What is an Escrow Account?

To put it simply, an escrow account is one where the third party retains the escrow assets or monies until both parties’ commitments have been fulfilled. In the housing market, they are most frequently utilized to make monthly mortgage payments, which frequently include annual fees as well as costs like taxes and insurance.To put it simply, an escrow account is one where the third party retains the escrow assets or monies until both parties’ commitments have been fulfilled. In the housing market, they are most frequently utilized to make monthly mortgage payments, which frequently include annual fees as well as costs like taxes and insurance.

Best Escrow Online Payment Services

Escrow services are listed below:

- Escrow.com

- Trustap

- SafeFunds

- Paylax

- Tazapay

These Escrow platform serve a variety of purposes, such as international transactions, real estate, and e-commerce.

How Does Escrow Work?

Escrow acts as a crucial mediator and safeguard for the money or assets involved in a transaction in any circumstance when there is doubt about it between the two parties. The most typical usage of escrow is in real estate, but it is also utilized in many other situations, such as mergers and acquisitions, where substantial sums of money, assets, or intellectual property are at risk.As a common example, consider a new company that wants to sell its products or services to another company in a different nation. The company that is selling will want to know that it will be paid when the goods or services are delivered, and the company that is purchasing will want to know that the goods arrive in the condition that was agreed upon or that the service is provided to the level of satisfaction that was agreed upon. Both sides are protected until both are pleased if the buyer puts the money in escrow.

Rules for Online Escrow

Before escrow is released, a number of requirements may need to be fulfilled. In the simplest terms, the vendor must provide the good or service, and the consumer must provide the money. However, the criteria to be negotiated are frequently more complex.For instance, the seller may require evidence of payment, or the buyer may want to check the transaction before releasing funds. When one party has a cause to be suspicious of the other, there may be special issues; in these cases, the escrow provider must serve as a kind of mediator. Using a reputable and trustworthy escrow company with a solid track record is therefore always a good idea.

Online Escrow Payment

Any online transaction has some risk, particularly if the seller is based in a different nation or even continent. There are additional issues to take into account in a business-to-business deal because suing another company is always going to be frightening and maybe expensive.Using your credit card’s consumer protection features or dealing only on reputable online marketplaces like eBay and Amazon are two ways to get around this problem. However, escrow is the only sensible choice for larger transactions. While the specifics are being worked out, the third party can keep money in an escrow account and the buyer and seller can lay down their stipulations.

Why Make Use of Escrow?

Business escrow is ultimately a way to protect your transaction and make sure that fraud cannot occur. Of course, it means entrusting your destiny to someone else. However, if it’s someone you trust, you might also view it as a way to let them handle the details so you can concentrate more on the important things.

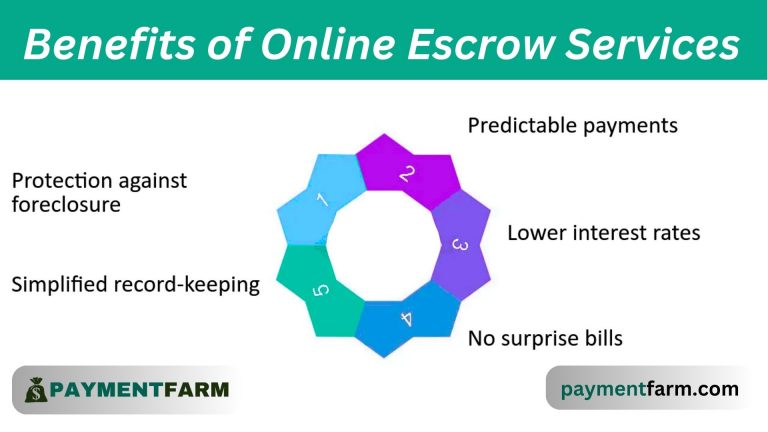

The Benefits of Online Escrow Services

Online escrow services can provide many benefits for buyers and sellers, including secure transactions, fraud protection, and peace of mind. These services ensure that funds are only released when both parties fulfill their obligations, reducing risk and increasing trust.

- Accounts for Escrow: Secure escrow accounts are made available to buyers and sellers via online escrow services, which make it easier to transfer money for purchases or payments. This gives both parties the assurance that their funds are safe because they are being kept in trust by a third-party provider until all conditions are satisfied.

- Management of Funds: Online escrow services offer a mechanism that enables both buyers and sellers to safely deposit money into an escrow account and withdraw that money after both parties have complied with all agreement requirements.

- Protection Against Fraud: By giving the buyer precise information about who will retain and handle the payment until everything in the agreement has been properly completed, online escrows are intended to lower the risk of fraud. This can assist in preventing the direct transfer of buyers’ funds to another party without adequate authentication or safeguards against fraud or illegal conduct.

- Schedules of Payment: When processing payments between two parties, escrow businesses give users the option of variable payment schedules. This allows payments to be spread out over time rather of being exchanged in one big sum all at once. To help everyone in the transaction stay on top of their duties and responsibilities throughout the process, they also provide automated reminders when future payments gateway are due.

- Features of Security: In order to safeguard consumers’ sensitive financial information from prospective hackers or intruders during any transactions they may engage in using their service platform, many online escrows provide extra security features including encryption, authentication processes, multi-signature approvals, and more.

For Whom Are Online Escrow Services Beneficial?

Online escrow services are beneficial for buyers and sellers engaging in high-value or high-risk transactions, ensuring funds are securely held until all terms are met. They provide added protection, trust, and transparency in various industries such as real estate, e-commerce, and freelance work.

- Businesses: For companies that require a safe method of receiving and retaining funds from clients or consumers, online escrow services are perfect. Businesses can feel more at ease when they receive payments for goods or services thanks to the service’s extra security and transaction protection.

- Freelancers: Freelancers frequently need a simple, secure method of getting paid for their work. By using online escrow services, clients can be sure they won’t be charged until the project is finished as planned, and freelancers can be sure they will be paid when the project is finished.

- Uctioneers: Because online escrow services are safe and convenient, they can be quite beneficial to online auctioneers. Serving as a middleman between buyers and sellers, an escrow account safely retains money until all parties concur that the item has been received in acceptable condition, at which point the money is released to the seller.

- Individual Vendors: To guard against fraud attempts and payment failures at any point during the transaction process, people typically need secure payment processors, such as online escrow businesses, whether they are selling goods on a private website or a classifieds site.

- Health Care Workers: Medical practitioners’ billing operations also benefit greatly from online escrow accounts since they enable them to swiftly collect patient money without having to worry about collecting past-due or unpaid invoices. Even when handling high volumes of transactions across several nations with different currencies, this kind of solution enables medical professionals to efficiently manage financial operations through secure collecting techniques.

To Sum Up

Popular platforms such as Escrow.com, Trustap, and Tazapay serve a variety of needs, including e-commerce, real estate, and cross-border business deals. By ensuring compliance with agreed terms, escrow accounts streamline transactions, fostering trust and lowering the potential for costly conflicts. Digital escrow payment platforms serve as trusted third parties that hold and release funds or assets only when the terms of a transaction are met, ensuring security and fairness. These services are essential for reducing risks in high-value or international transactions, providing safeguards against fraud while mediating disputes.

FAQS

What is an online escrow service?

An online escrow service is a service that holds funds or assets in a secure account until both parties fulfill the terms of a transaction.

How does an escrow service work?

A buyer places money in escrow. The funds are released to the seller only after conditions agreed upon have been met.

What are the benefits of using escrow?

- Prevention of fraud

- Security of transactions

- Flexibility in schedules of payments

- Mediation of disputes

Who should use escrow services?

- Businesses dealing with high-value transactions

- Freelancers who require secure payment

- E-commerce sellers

- People doing high value deals

Which are the best escrow services?

Escrow.com, Tazapay, Trustap, SafeFunds, Paylax.

Are escrow services cross-border?

Yes, because many of these services major in cross border payments as well as multi-currency transactions.

Are escrow platforms suitable for cross-border transactions?

Yes, many escrow platforms specialize in cross-border payments and multi-currency transactions, providing a secure framework for international deals.

How do I choose the best online escrow platform?

Consider factors such as the platform’s reputation, fees, range of services, security measures, and customer support. Popular platforms include Escrow.com, Tazapay, Trustap, and SafeFunds.

What are the fees associated with online escrow services?

Fees vary by platform and transaction size but typically include a small percentage of the total transaction amount as the service charge.

Can individuals use online escrow platforms for personal transactions?

Yes, escrow services are ideal for high-value personal transactions, such as selling a car or expensive equipment, ensuring that both parties are protected throughout the deal.