In the universe of credit card transactions, little charges can become huge losses over time. As either a small business proprietor or running a big company, keeping your payment processing expenses in check is crucial. One of the effective ways to do so is through a Free Card Fees Audit—a detailed, no-fee audit that helps to detect and decrease unnecessary fees associated with your merchant account.

What is a Free Card Fees Audit?

A Free Card Fees Audit is an in-depth review of your existing credit card processing fees, merchant account fees, and other related charges. The objective is to identify areas where you’re being overcharged and provide recommendations for lowering your payment processing fees. Many business owners aren’t even aware of how much they’re paying in hidden charges. This is where an audit becomes essential it brings clarity and insight into what you’re really being charged.

Key Areas Analyzed in a Free Card Fees Audit

- Credit Card Fee Audit: At the heart of any audit is the credit card fee audit, which reviews your statement line-by-line. This process identifies hidden markups, unnecessary surcharges, and erroneous charges that may be increasing your overall costs.

- Merchant Services Cost Analysis: A merchant services cost analysis examines the total expenses related to your merchant account fees, including fees for customer service, risk management, and more. This analysis helps compare your current setup with industry standards.

- Interchange Fees: Sometimes confused, interchange fees are charged by card networks (such as Visa and Mastercard) and paid to the issuing bank for the card. Although these cannot be negotiated, some processors conceal additional markups in them that can be uncovered during the audit.

- Transaction Fee Audit: Transaction fee audit ensures that any per-transaction surcharges or wrong rates charged to various card types or transaction means are revealed.

- Credit Card Surcharge Analysis: If you are passing on fees to your consumers, a credit card surcharge analysis will assure you’re doing so in accordance with the regulations while staying within acceptable costs and legal parameters.

- Payment Gateway Fees: The other key aspect is your payment gateway fees—the ones that come separate from your processor and have wide variability. Audits frequently identify improved options that reduce gateway expenses.

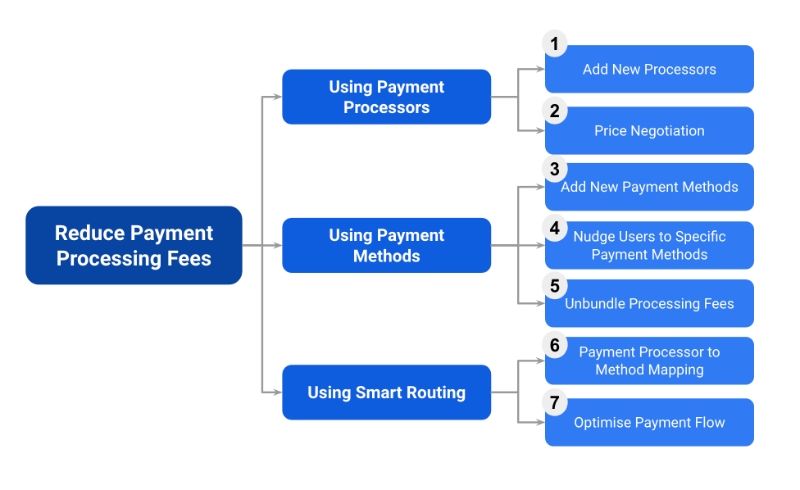

Methods of Minimizing Processing Cost

- Merchant Account Cost Reduction: By conducting an audit, you can implement actionable methods for lowering merchant account costs this means renegotiating contracts, eliminating duplicate services, and so forth.

- Credit Card Processing Cost Comparison: A credit card processing cost comparison is a benchmark against other processors. This enables you to determine if you’re being charged fair market rates and negotiate reduced fees based on that.

- PCI Compliance Fees: Your audit will review PCI compliance fees, which make your business adhere to security levels. Businesses sometimes get charged for services they’re not even utilizing or have overlapping coverage.

- Chargeback Fees: Chargeback fees are another expensive concern for most merchants. Audits will decide whether you’re paying too many penalties and provide recommendations to reduce future disputes by enhancing transaction documentation and applying fraud filters.

Commonly Overlooked and Hidden Fees

- Monthly Minimum Fees: These fees are assessed when your volume of transactions doesn’t reach a predetermined level. An audit will determine if these monthly minimum fees are negotiable or avoidable based on your past volume.

- Statement Fees: Most companies continue to pay statement fees—either for paper statements or administrative fees which can be waived with a quick call or eliminated by converting to digital-only services.

- Batch Fees: Your batch fees (charged every time transactions are settled) can add up. Audits determine whether you’re being charged fairly and recommend processors with lower batch rates.

- Setup Fees: Some providers sneak in setup fees that are not always disclosed upfront. These are often unnecessary or outdated, and modern processors frequently waive them.

- Refund Fees: Refunds must be cheaper than purchases, yet most merchants continue to pay full-refund fees. An audit will highlight this inefficiency and provide suggestions on vendors that handle refunds more equitably.

- Gateway Fee Analysis: A gateway fee analysis examines deeper into recurring and transaction-level fees that your payment gateway may be charging. This can reveal redundant billing or unwanted add-on features.

Specialized and Rare Fees to Monitor

- AVS Fees: AVS charges (Address Verification Service) can assist you in avoiding fraud, but high charges can take a bite out of your earnings if not kept in check. An audit will inform you if your AVS charges are up to industry standards.

- Voice Authorization Fees: No longer used today, voice authorization fees need to be audited to ensure you’re not paying for services that are no longer applicable.

- IRS Reporting Fees: Some processors impose IRS reporting fees on filing tax forms—something that frequently can be accomplished at no cost or handled internally with little effort.

- Assessment Fees: Assessment fees from card brands are unnecessarily marked up by processors. Your audit provides openness in this regard by separating actual card brand expenses from exaggerated markups.

- Markup Fees: All processors have markup fees, but unnecessary or sneaky ones can significantly raise your effective rate. These are normally the most negotiable and frequently the simplest manner to save overall cost.

- Processing Commitment Fees: Are you being charged processing commitment fees on volume you’re not achieving? If that’s the case, you might be better suited with a more adaptable provider that has month-to-month arrangements or scalable charges.

- Incidental Fees: Incidental fees are such as retrieval requests, terminal replacements, or excessive chargebacks. Some are valid, but others are random and can be removed or limited.

- Red Flag Fees: Red flag fees are suspicious or non-standard charges that show up sporadically on your statement. An audit will mark these for follow-up and include supporting documentation to dispute them.

Next Steps After the Audit

- Hidden Merchant Fees: The most significant value of a Free Card Fees Audit is discovering latent merchant fees that are not openly apparent—such as tiered pricing markups or hidden network fees.

- Credit Card Fee Negotiation: Your audit team can assist with credit card fee negotiation to reduce charges with your current or new processor once these are known. This frequently translates to hundreds or thousands in savings every year.

- Merchant Account Fee Audit: A complete merchant account fee audit guarantees you’re only paying for what you use and nothing else. It also positions you for future billing clarity.

- Payment Processor Fee Comparison: If your current processor is unmoving, a payment processor fee comparison provides you with negotiating power to move to a better rate that aligns with your volume and risk profile.

The End Goal: Lowering Costs and Gaining Control

Ultimately, the audit is all about lowering credit card processing fees and boosting your profit margins. It provides you with more credit card fee transparency and complete control of your merchant account. A breakdown of merchant fees changes your cost structure from a black box to an open, readable document. With knowledge of credit card fee models, you’ll be better equipped to manage and negotiate fees proficiently. You won’t find yourself bound by long-term contracts that charge you for expansion or seasonal fluctuations. Breakdown of a payment processing cost provides an overall overview of every expense enabling you to consider where to make the first cuts and what value-added services are actually worth it. Lastly, you will leave with total merchant account fee disclosure so you can make knowledgeable business decisions down the road with more control and confidence.

Long-Term Benefits of a Free Audit

In addition to short-term savings, the long-term rewards of a Free Card Fees Audit are better forecasting, more robust vendor relationships, and fewer surprise charges. Companies that plan regular audits are more likely to stay competitive and nimble, particularly in volatile markets. An annual or semi-annual merchant account fee audit also fosters internal consciousness, keeping your finance or operations staff one step ahead of price changes and negotiating more favorable terms in the long run. Some audit firms even provide integration with accounting software or payment analytics platforms to track real-time trends in your credit card processing fees putting you in control to take action before costs get out of hand.

Conclusion

A Free Card Fees Audit is more than a diagnostic tool more like a savings map. By revealing hidden fees, detecting overcharges, and using provider comparisons, you can cut your overhead dramatically. If you are committed to building your bottom line, there’s no better point to begin than with a complimentary audit of what you’re currently charging. Through increased knowledge, thorough examination, and aggressive negotiating, you can take back your payment ecosystem—and make every swipe pay off in your favor.

FAQs

What is a Free Card Fees Audit?

A Free Card Fees Audit is a free analysis of your merchant account and related fees to identify unnecessary charges and reduce your payment processing expenses.

How long does the audit process take?

Generally, a standard audit can be finished within a few business days. More in-depth studies can take 1–2 weeks, depending on your transaction volume and number of statements.

Will my existing payment arrangements be interrupted by this audit?

Not at all. The audit is a low-key process and does not obligate you to change providers or systems unless you wish to do so based on the recommendations.

Am I going to need technical know-how to understand the audit output?

No. Audit providers commonly report findings in simple language backed up by illustrations and side-by-side comparisons designed to make the findings easy to comprehend.

Can I do it myself?

You can read through your statements by hand, but professional auditors tend to spot concealed charges and fine print that might go unnoticed easily.

Do I have to change processors after the audit?

No. You are not required to make adjustments. The audit does, however, provide you with the information and negotiating power to negotiate improved terms if you so desire.

Will the audit assist in decreasing chargebacks?

Yes. Although not the ultimate objective, audits tend to expose problems in handling transactions or fraud tools that can assist in decreasing chargebacks.

How frequently should I have an audit?

At least annually, or whenever your processing volume dramatically rises or you suspect alterations in your fee structure.

Will this audit work for multi-location or web businesses?

Absolutely. Audits may be applied to several terminals, gateways, or eCommerce sites, providing a comprehensive picture of your processing environment.

Is the Free Card Fees Audit actually free?

Yes, it is usually provided free of charge by most providers as a value-added service. Make sure to check there are no underlying consulting or setup fees.