In today’s digital world, e-commerce has become an essential part of the global economy. Online shopping, digital subscriptions, and virtual services have all increased the reliance on seamless, secure payment methods. One crucial technology enabling this growth is the payment gateway. Despite being a term often seen in online transactions, many people don’t fully understand how a payment gateway works. In this article, we will explain the inner workings of payment gateways, their components, and their role in online transactions.

What Is a Payment Gateway?

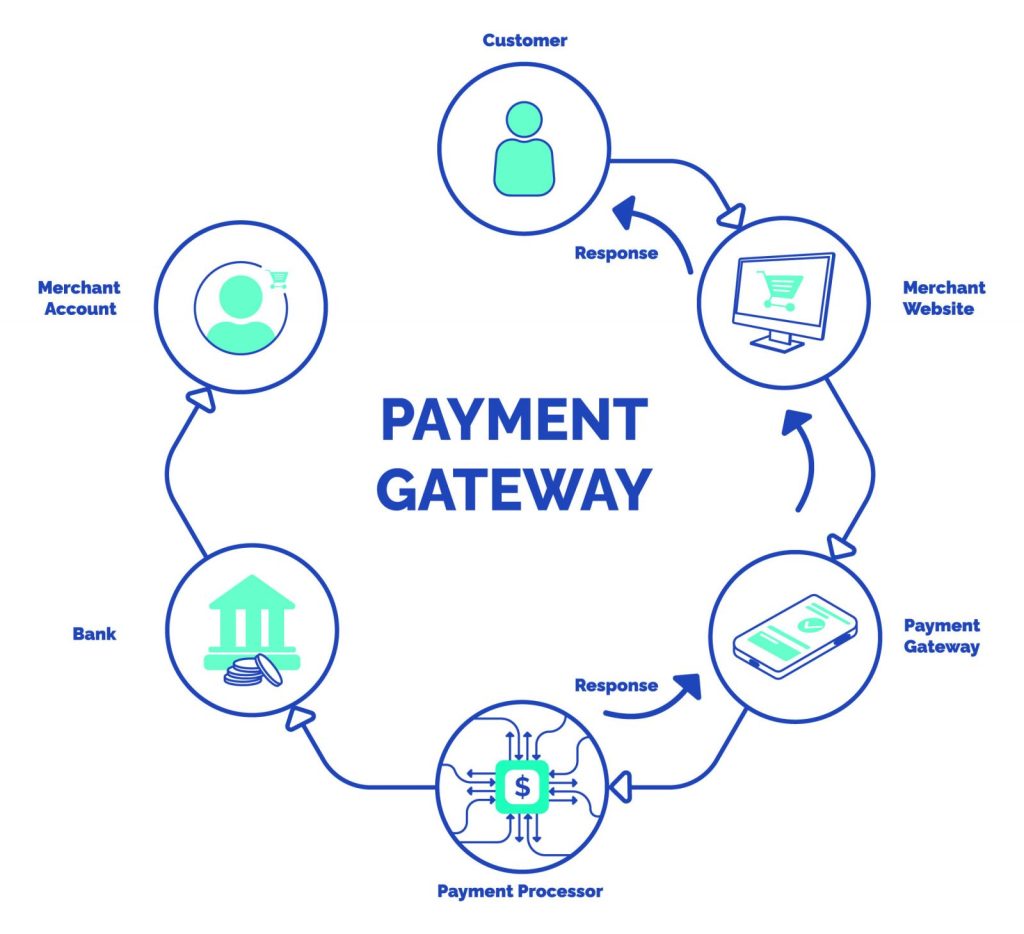

A payment gateway is a technology that facilitates the transfer of payment information from a customer to a merchant and then from the merchant to the financial institutions involved. Essentially, it acts as the digital equivalent of a point-of-sale (POS) terminal in physical stores, ensuring that sensitive information, such as credit card numbers, is securely transmitted for authorization and processing.

Payment gateways are not responsible for actually holding or moving money—they are a secure bridge between the customer, merchant, and banks or payment processors. They verify, encrypt, and transmit transaction data, reducing the risk of fraud and ensuring smooth processing.

Key Components of a Payment Gateway

Understanding how a payment gateway works begins with recognizing its key components:

- Customer Interface

This is the front-end component where a customer initiates the transaction. It could be a checkout page on a website, an in-app payment screen, or a POS terminal in a physical store. Customers enter their payment details here, such as credit/debit card information or digital wallets. - Merchant’s Server

Once the customer submits payment information, the merchant’s server receives the data and forwards it to the payment gateway. This server is responsible for securely transmitting the data while ensuring the transaction details remain confidential. - Payment Gateway Server

The gateway server is the core of the system. It encrypts sensitive data, communicates with the payment processor, and returns the approval or rejection status of the transaction. Most modern payment gateways use SSL encryption to protect financial data. - Payment Processor

The payment processor is the financial institution or company that handles the actual processing of the transaction. The processor communicates with the issuing bank (customer’s bank) and the acquiring bank (merchant’s bank) to authorize and settle payments. - Issuing Bank and Acquiring Bank

- The issuing bank is the bank that issued the customer’s card or account. It validates the transaction and ensures sufficient funds are available.

- The acquiring bank is the bank that maintains the merchant’s account. Once the transaction is approved, the acquiring bank deposits funds into the merchant’s account.merchant’s account.

Step-by-Step Process of How a Payment Gateway Works

Let’s break down the entire process into steps to see exactly how a payment gateway functions during an online transaction:

1. Customer Initiates Payment

The process starts when a customer selects a product or service and proceeds to checkout. They enter their payment details—credit/debit card numbers, CVV codes, expiration dates, or digital wallet information.

At this stage, the payment gateway collects this sensitive data and prepares it for secure transmission.

2. Data Encryption and Transmission

The payment gateway immediately encrypts the customer’s data to protect it from hackers or unauthorized access. Encryption converts the information into unreadable code, ensuring that sensitive data like card numbers and passwords are secure during transmission.

The encrypted data is then sent from the merchant’s server to the payment processor through secure communication channels.

3. Transaction Authorization

The payment processor forwards the encrypted transaction request to the issuing bank. The bank verifies several key details:

- Card number validity

- Expiration date

- Available funds or credit limit

- Suspicious or fraudulent activity

After verification, the issuing bank sends an authorization response back to the payment processor, indicating whether the transaction is approved or declined.

4. Approval or Decline

Once the processor receives the response from the issuing bank, it forwards this information to the payment gateway. The gateway then communicates the result to the merchant and the customer.

- If approved, the customer sees a confirmation message, and the merchant prepares the order for fulfillment.

- If declined, the customer may be prompted to retry or use another payment method.

5. Settlement and Funds Transfer

Authorization does not immediately transfer funds—it only guarantees that the customer has sufficient balance or credit. The actual transfer occurs during the settlement phase.

In this phase:

- The acquiring bank deposits the payment into the merchant’s account.

- The issuing bank deducts the amount from the customer’s account.

- The transaction is recorded for reconciliation by both banks.

6. Security and Compliance

Throughout this process, payment gateways ensure compliance with Payment Card Industry Data Security Standard (PCI DSS) regulations. These standards dictate how sensitive payment information must be handled, stored, and transmitted.

Some gateways also integrate fraud detection mechanisms, such as monitoring IP addresses, tracking unusual purchase patterns, or validating CVV codes, to reduce fraudulent transactions.

Types of Payment Gateways

Payment gateways come in different forms depending on the business’s needs:

- Hosted Payment Gateways

These redirect customers to the gateway’s payment page to complete transactions. Examples include PayPal and Stripe’s hosted checkout. The merchant never directly handles sensitive card data, reducing PCI DSS compliance burdens. - Integrated Payment Gateways

These allow transactions to occur directly on the merchant’s website or app without redirection. They provide a seamless customer experience but require more rigorous PCI DSS compliance. - API-Based Gateways

Application Programming Interface (API) gateways allow developers to fully integrate payment functionality into apps or websites, providing flexibility and advanced customization. - Mobile Payment Gateways

Specifically designed for mobile apps, these gateways support in-app payments, digital wallets, and one-click checkout features.

Advantages of Using a Payment Gateway

Using a payment gateway offers several benefits for both merchants and customers:

- Security: Encryption and fraud detection protect sensitive financial data.

- Convenience: Customers can pay using cards, digital wallets, or online banking.

- Speed: Transactions are authorized in seconds, and funds are settled quickly.

- Global Reach: Merchants can accept payments from anywhere in the world.

- Compliance: Gateways ensure adherence to PCI DSS and other regulatory standards.

Common Challenges and Considerations

While payment gateways are essential for online businesses, they come with some challenges:

- Transaction Fees

Most gateways charge a percentage of each transaction or a fixed fee per transaction, which can affect small businesses’ margins. - Integration Complexity

Some gateways require complex setup and integration, especially API-based or fully integrated solutions. - Declined Transactions

Payments may be declined for various reasons, such as insufficient funds, incorrect card details, or security flags. Merchants need processes in place to handle these cases efficiently. - Technical Issues

Server downtime, connectivity issues, or software glitches can temporarily disrupt the Payment Gateway Works, affecting sales and customer trust.

Conclusion

A payment gateway is a critical component of online commerce, ensuring secure and seamless financial transactions between customers, merchants, and banks. By encrypting sensitive data, verifying transactions, and coordinating with financial institutions, payment gateways make digital Payment Gateway Workspossible. For businesses, understanding how a payment gateway works is essential for choosing the right solution, integrating it efficiently, and providing a secure and smooth checkout experience. For customers, it provides peace of mind knowing that their financial information is protected while making online purchases. In a world where digital transactions continue to grow, payment gateways will remain at the heart of the online economy, bridging the gap between buyers and sellers while maintaining security and efficiency.