In the current legal practice, law firms need to provide more than professionalism and expertise they need to be convenient as well. Perhaps one of the most significant places where law firms can be updated and adapt to client demands is in payment. Whether through allowing clients to pay online, providing payment arrangements, or complying with trust account regulations, having the right Law Firm Credit Card Processing system is critical for practices of any size.

In this in-depth guide, we’ll explore how legal-specific payment processing for lawyers works, what features to look for, how to stay compliant with legal and ethical rules, and why modern solutions like LawPay are the gold standard for law firms across the U.S.

Why Credit Card Processing Matters for Law Firms?

Credit card acceptance was once rare among attorneys. Most felt it was too complicated to marry with trust accounting regulations or that transaction fees would cut into revenue. That has all changed over the past decade, however. In 2025, more than 80% of clients expect to pay legal fees using credit or debit card, based on statistics from the American Bar Association (ABA). However, Law Firm Credit Card Processing can’t just utilize any off-the-shelf payment processor. Legal billing deals with sensitive client trust accounts, retainer payments, and regulations governing separation of funds. That’s why law firm payment processing needs systems specifically designed for attorneys. A specialized credit card processing for law firms platform is now not merely a convenience but a compliance imperative.

Special Requirements for Credit Card Processing for Lawyers

When it comes to credit card processing attorneys have to contend with highly specific regulatory issues that most other sectors do not. These are the key requirements for any legal payment solution:

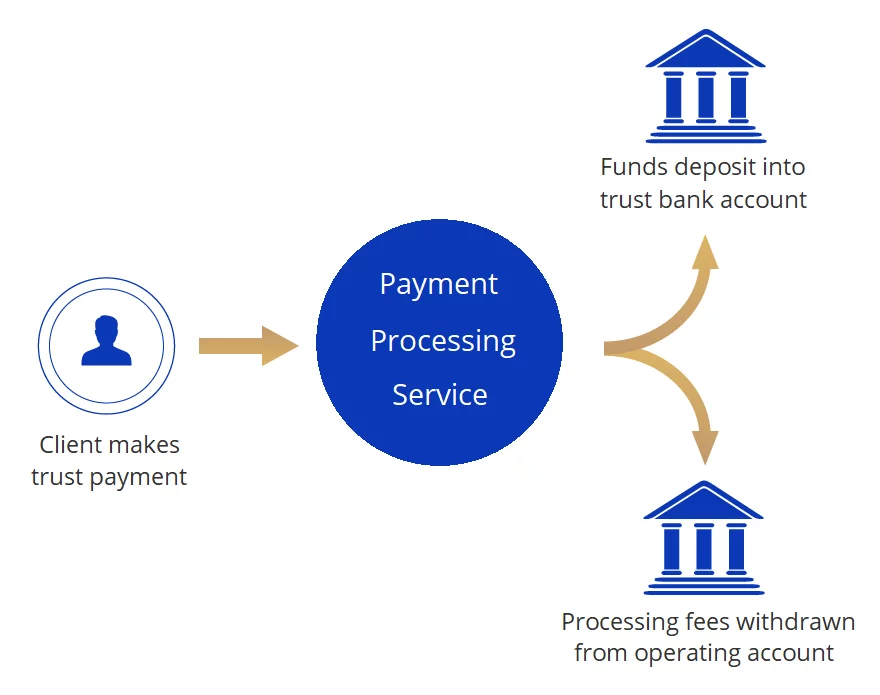

- Trust Account Compliance: Lawyers must hold client money in an isolated trust account (IOLTA) until they’ve been earned. Normal payment processors regularly don’t distinguish processing fees from the trust account, leading to ethical breaches. Legal-specific processors like LawPay make sure that transaction fees get debited out of the firm’s operating account—never from the trust.

- No Third-Party Access: Ethical guidelines prevent third-party providers from accessing or having control over trust account money. Any law firm credit card processing provider thus needs to keep client money un-accessible by third parties.

- Secure and Confidential: Your law firm payment processing attorney solution needs to be secure and encrypted, in addition to being PCI-compliant, in order to protect sensitive legal payment information.

- Ability to Accept Advanced Fee Payments: Clients usually have to prepay retainers or flat rates before legal work commences. A payment solution that is compliant ought to enable initial deposits into a trust account without raising ethical issues.

Benefits of Having Legal-Specific Payment Platforms

There are hundreds of advantages to having a custom Law Firm Credit Card Processing platform compared to a generic solution such as Stripe Radar responed, Square, or PayPal.

- Effortless Compliance with Legal Ethics: The top benefit of legal-specific platforms is compliance built-in. You won’t risk accidentally commingling funds or doing something that will get you investigated by a bar.

- Quicker Payments and Better Cash Flow: Enabling clients to pay right away via credit card, ACH transfer, or mobile link shortens collection cycles. Law firms that provide contemporary payments lawyer choices usually receive payment 39% quicker than those that don’t.

- Increased Client Convenience: Clients want simple payment options. Whether they’re paying from their office, couch, or phone, your capacity to provide them with a means to make a payment processing on LawPay or other similar platforms instills confidence and professionalism.

- Time-Saving Integrations: Legal payment solutions tend to integrate with case management software like Clio, MyCase, PracticePanther, and others. This saves the time of duplicate data entry and simplifies billing.

How to Set Up Law Firm Payment Processing

- It doesn’t have to be difficult to get credit card processing underway with lawyers. The majority of good legal payment processors guide you through each step. It’s this easy:

- Step 1: Select the Proper Provider: Find a processor specializing in Law Firm Credit Card Processing, like LawPay, Gravity Legal, or LexCharge.

- Step 2: Create Your Trust and Operating Accounts: You’ll require an IOLTA account for unearned funds as well as a business operating account for earned fees. Make sure your processor has the ability to divide payments and fees between these accounts properly.

- Step 3: Brand Your Payment Links: Create branded payment pages where clients can make a payment on LawPay or whatever provider you have. Insert these links on your website, invoices, or emails.

- Step 4: Train Your Team: Make sure everyone on staff who deals with billing knows how the platform operates and how it keeps you in compliance.

What to Look for in a Law Firm Credit Card Processing Provider

Here’s a checklist of features every legal payment processor should offer:

Feature | Why It Matters |

Trust Account Support | Ensures client funds stay compliant with IOLTA rules. |

Operating Account Integration | Routes fees properly to prevent violations. |

PCI Compliance | Keeps client payment data secure. |

Custom Payment Pages | Enhances branding and professionalism. |

Recurring Billing | Ideal for subscription-based legal services. |

Mobile Payments | Allows you to collect payments anywhere. |

Time & Billing Software Integration | Reduces admin time and errors |

Why LawPay Is the Industry Standard

LawPay is the industry leader in credit card processing solutions for attorneys. It is endorsed by more than 50 state bars, the ABA, and numerous local bar associations. Here’s why it leads the way:

- Total Trust Compliance: Built from scratch for attorneys.

- Ease of Use: Simple payment is made easy on LawPay by email link or on your website.

- Seamless Integrations: Integrites seamlessly with Clio, MyCase, and many others.

- Transparent Pricing: Pay one flat fee. No surprise billing.

- Mobile App: Accept payments anywhere, anytime.

- LawPay is the gold standard. Others are judged against it.

Security and Ethics Considerations

Ethical compliance is essential when dealing with credit card processing lawyers. Here’s how to ensure your firm meets its obligations:

- Avoid Commingling: Never mix client trust funds with operating funds. Use a processor that splits transactions correctly.

- Disclose Processing Fees: While clients can pay by card, it’s usually unethical to pass the processing fee on to them unless your state bar allows it. Always check your local rules.

- Secure Storage of Payment Info: If you’re storing credit card info for future bills, it should be encrypted and PCI compliant.

Common Mistakes to Avoid

Despite proper software, there are a few errors that can compromise compliance:

- Using Business Accounts for Private Transactions: Don’t ever use personal or non-compliant business accounts to process client payments.

- Not Converging Settings: If you’re integrating other tools with your platform, double-check it’s properly set to prevent accounting glitches.

- Avoiding Reconciliation: Regularly reconcile your trust account so that no money goes missing or is misapplied.

- Failure to Train Staff: Ensure your staff knows ethical billing procedures and how to use payment lawyer tools correctly.

The Future of Payments in the Legal Sector

The need for digital solutions is only increasing. Beyond online payments, law firms are now considering:

- Buy Now, Pay Later legal fee solutions.

- Client Portals with billing dashboards.

- Automated Email and SMS Reminders.

- E-checks and ACH Payments as cheaper options over credit cards.

By adopting future-proofed payment processing systems for law firms, lawyers prepare to succeed in the digital economy era.

Conclusion

The law profession has a basis in tradition but not that it should remain out of date. Adapting to current, secure, and compliant law firm credit card processing can enhance law firm operations, better meet clients’ needs, and keep them one step ahead of ethics traps. Whether you’re an individual practitioner or a multi-attorney law firm payment processing, today is the day to review the way you process payments. From providing clients the option to take a payment via LawPay to making sure that your firm’s credit card processing is ethical and for law firms, the solution is out there and easier than ever before. Making the move to specialized law firm payment processing for lawyers is not just about convenience. It’s about security, compliance, and running your firm like a 21st-century business.

FAQs

Are law firms permitted to accept credit card payment processing from clients legally?

Yes, law firms can accept credit card payment processing legally as long as they adhere to state bar association established ethical standards. Utilizing a provider that has law firm credit card processing geared specifically for attorneys ensures that attorneys are in accordance with trust account and client fund handling regulations.

How should a client pay a law firm online?

The most compliant and best method is paying on LawPay or a like legal-specific system. These systems keep earned and unearned fees separate, hold trust account compliance, and provide secure, convenient payment options.

Is it ethical to pass credit card processing fees on to clients?

That depends on your state. Some states bars forbid transmitting credit card charges for attorneys fees to clients, while others permit it under certain circumstances. Always refer to your state bar rules or ethics opinions.

Why can’t I use Square or PayPal to receive law firm payment processing?

General processors such as Square, PayPal, or Stripe are not built to facilitate legal trust accounting needs. They tend to take fees from the incorrect accounts with the risk of ethical breaches. law firm payment processing for attorneys guarantees ethical treatment of client money and ABA compliance.

What are the consequences of using a non-legal payment processor?

Using a non-legal processor may lead to:

- Commingling of client and firm money

- Unethical withdrawal of fees from trust funds

- Risk of state bar sanction

- That is why law office payment processing sites such as LawPay are invaluable.

How does LawPay ensure trust accounts remain in compliance?

LawPay is architected to never take processing fees out of your IOLTA (trust) account. You pay all your fees from your operating account, keeping separation and ethical compliance alive in Law Firm Credit Card Processing for legal offices.

Can recurring billing be applied to legal services?

Yes. Most legal payment systems have the ability to accept recurring billing. This is particularly convenient for subscription or flat-fee services and can be set up quickly within most Law Firm Credit Card Processing attorneys’ systems.

Is online payment safe for my clients?

Yes. When you process payments with a PCI-compliant platform such as LawPay, client information is encrypted and secured. With reputable law firm credit card processing tools, your practice and your clients are safeguarded against fraud and data breaches.

How quickly do I get paid on client payments?

The majority of law firm payment processing vendors transfer funds to your account in 1–2 business days. A few have same-day or next-day deposits for a fee.

What if a client complains about a charge (chargeback)?

Chargebacks may be tricky in the legal practice. Tools such as LawPay provide legal-specific assistance with chargeback dispute and documentation support. Having clear invoices and service contracts can mitigate the risk of chargebacks in payments lawyer systems.