Payment gateways are technological tools that safely approve payments for both online and offline transactions. Businesses may increase their reach, obtain comprehensive transaction data, and make their processing tools more versatile for more clients by utilizing numerous payment gateways. The benefits and drawbacks of using multiple payment gateways will be discussed, along with integration and support strategies and features to consider.

The best split payment gateway providers

Multi-payment processing solutions that support various payment methods and integrations are listed below. These are the best Multi-split payment systems in Europe and also Payment gateway for businesses in Europe.

- PayPal for Marketplaces

- Stripe Connect

- Adyen MarketPay

- Payoneer

- Razorpay Route

- Mangopay

- Square

- Dwolla

- Hyperwallet

- Splitit

Multi-payment gateway solutions

- Rapyd

- Payoneer

- Checkout.com

- Adyen

- Stripe

- Worldline

- Braintree

- Spreedly

- Authorize.Net

- BlueSnap

Split payment systems for different businesses

Payment gateway for multiple recipients

Here are some payment gateways that specialize in handling payments to multiple recipients:

- Stripe Connect

- PayPal for Marketplaces

- Adyen MarketPay

- Mangopay

- Hyperwallet (PayPal Service)

- Payoneer

- Dwolla

- Razorpay Route

- WePay (Chase)

- Braintree Marke

Split payment gateway for ecommerce

Online payment gateway for multiple payees are listed below:

- Stripe Connect

- PayPal for Marketplaces

- Adyen MarketPay

- Mollie

- Razorpay Route

- WePay (Chase)

- Mangopay

- Braintree Marketplace

- Payoneer

- Lemonway

Multi-payment processing for merchants

- Stripe

- PayPal

- Adyen

- Square

- Checkout.com

- Braintree

- Worldpay

- 2Checkout (Verifone)

- Mollie

- Klarna

Multi-split payments for freelancers

- Upwork

- Fiverr

- Freelancer.com

- Toptal

- Guru

- PeoplePerHour

- TaskRabbit

- 99designs

Multi-split payment gateway for digital products

- Stripe Connect

- PayPal for Marketplaces

- Adyen MarketPay

- Braintree Marketplace

- Razorpay

- Payoneer

- Mollie

- Checkout.com

- WePay

- Paddle

Multi-split payment gateway for marketplaces

- Stripe Connect

- PayPal for Marketplaces

- Adyen MarketPay

- WePay (a JPMorgan Chase company)

- Razorpay

- Braintree Marketplace

- Payoneer

- Mollie

- Checkout.com

- Worldpay for Marketplaces

Multi-split payments for subscription services

- Stripe Connect

- PayPal for Marketplaces

- Braintree Marketplace

- Razorpay

- Adyen MarketPay

- Payoneer

- Mollie

- Chargebee

- Recurly

- Paddle

Multi-split payments for service-based businesses

- Stripe Connect

- PayPal for Marketplaces

- Adyen MarketPay

- WePay

- Razorpay

- Braintree Marketplace

- Payoneer

- Mollie

- Paddle

- Chargebee

Multi-split payment gateway for mobile apps

- Stripe Connect

- PayPal for Marketplaces

- Adyen MarketPay

- Razorpay

- WePay

- Braintree Marketplace

- Payoneer

- Mollie

- Checkout.com

- Paddle

Steps for Split payment integration

Multi-recipient payment gateway integration are listed below:

- Choose a Payment Gateway: Choose one of the following – Adyen MarketPay, PayPal for Marketplaces, or Stripe Connect.

- Create a Developer Account: Register for API keys for test as well as live environments.

- Payment Gateway API integration for split logic and payments: You can create or manage all split logic and payments using SDKs or the REST APIs.

- Define recipient accounts: Ensure that each recipient is validated through a gateway account

- Implement Split Logic: Choose whether to split payments into fixed amounts or percentages.

- Check the Integration: Test splits and edge cases in a sandbox environment.

- Deployment: Deploy the system into production, with monitorinq on transactions.

- Ensure Compliance: Monitor tax, legal, and KYC/AML requirements.

How multi-split payment gateways work?

Platforms can distribute a single payment among several receivers thanks to multi-split payment gateways. This is how they operate:

- Beginning of Pay-out: A consumer pays for products or services.

- Split Configuration: The platform details the percentage or fixed amount that is to be allocated to split the payout amount.

- Receiver Configuration: Each receiver is required to hold an account with a payment gateway.

- Transaction Processing: When the transaction has been successfully completed, the money is split based on the configuration.

- Payout Handling: Either instantaneously or at a set interval, money is transferred to the accounts of the recipients

- Reporting and Compliance: Gateways supply reporting capabilities and ensure regulatory compliance, for example, KYC.

- Fees: The transaction or payout fee may be charged by the platform.

How to manage split payments?

- Select a payment gateway (such as PayPal for Marketplaces or Stripe Connect) that accepts split payments.

- Create recipient accounts and complete the KYC procedure.

- Explain your split logic-percentage based or fixed amounts.

- Make sure the distribution of money and transactions is automated through integration with the API of the chosen Payment Gateway

- Provide the payouts to the recipients daily, weekly, or immediate

- Track the transactions for accuracy using the gateway’s dashboard

- Ensure legal compliance – according to tax laws, AML regulations.

- Manage the payout fees and transaction charges.

- Customer support for issues or disputes.

How to optimize multi-split payment systems?

Consider these key strategies to optimize split multi-payment systems:

- Select a Reputable Gateway: Apply a reputable gateway that allows support for multiple payments such as a split arrangement. Some of these gateways include PayPal or Stripe Connect.

- Establish Clear Guidelines for Payment: Define fee structures and the rationale behind the split clearly

- Automate Payments: Send scheduled payments to recipients automatically

- Enhance Security: Implement KYC/AML checks while ensuring your facility is PCI DSS compliant.

- Offer Different Means of Payment: Accept payment through different means, including cryptocurrency, e-wallets, and cards.

- Improve the User Experience: Ensure that the UI is both user-friendly and mobile optimizer.

- Track in Real Time: Monitor splits and transactions in real time for quick identification of problems.

- Be Transparent About Fees: Be transparent about any possible transaction or platform costs.

- Provide Excellent Support: Offer quick customer service when questions arise.

- Use analytics and reporting tools: Prepare detailed transaction reports for analysis and transparency.

Multi-split transaction gateway features

- Support for Multiple Recipient Payments: Enables the dissemination of a single transaction to several recipients, such as service providers, platforms, and vendors.

- Custom Split Logic: Allows for setting splits for every recipient either based on a percentage or fixed amounts.

- Scheduled or instant payouts: Allows recipients to receive rewards immediately or on a set schedule (daily, weekly, or customized schedules).

- Recipient Account Management: Handles account linking for payouts, registration, and KYC verification processes.

- Escrow Features: Holds the funds in escrow until particular conditions are met hence safeguarding both the buyer and seller

- Auto-deduction of fees: Automatically deducts commissions, platform fees, or transaction costs before leaving the rest to the beneficiaries.

- Reporting and Compliance: Provides detailed transaction reports and also with built-in compliance features: tax reporting, anti-money laundering checks.

- Monitoring Transactions: Tracking payments and splits in real-time, as well as sending updates on payout payments to recipients.

- Global Payment Facilitation: Suitable for cross-border payments as it accommodates multiple currencies

- Fraud Prevention: Employs fraud detection and prevention measures to ensure secure payments for receivers and customers.

- Integration with Other Systems: Enables to connect effortlessly with any third-party tool, marketplace, or eCommerce system to ensure smooth operations.

- Personal Branding: Enhances the user experience by having the ability of the platform to brand the payment experience for receivers.

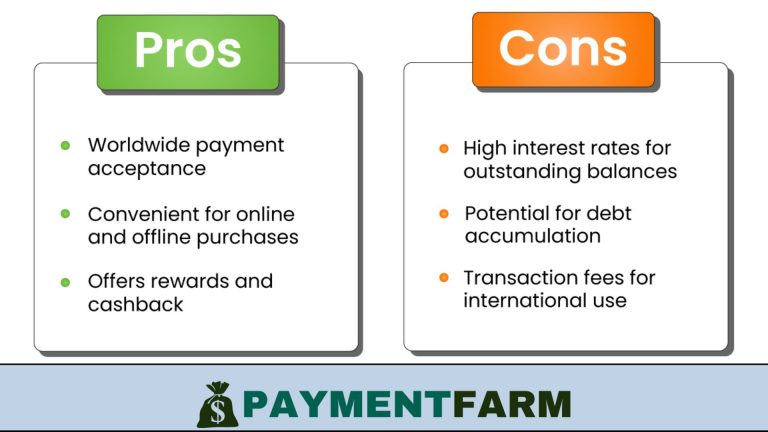

Pros and cons of Multi-split payment gateway

Pros

- Reduces manual work through automated payments.

- Enhances cash flow through the provision of quicker pay-outs to larger numbers of recipients.

- Revenue sharing rules that can be set up as percentage or fixed amounts.

- Enhances productivity through automation of payment processes.

- Enables international business by ensuring support for transaction in diverse currencies.

- Improves security with features such as compliance, encryption, and fraud prevention.

- Enhances transparency with detailed reports to facilitate monitoring and visibility..

Cons

- Complex technical implementation and configuration.

- More than one payee may result in additional transaction fees for payments.

- Manageability of tax reporting and KYC/AML

- Dependent on third-party services, which can impact the business.

- Few alternative payout options could restrict it.

- There could be limitations on the frequency of withdrawing or delays in payouts.

- Incorrect payout might arise from improper configuration or poor communication.

- Integration could be costly and time-consuming with respect to the current infrastructure.

To sum up

A multi-split payment gateway automates the process and provides configurable split rules, allowing platforms to effectively distribute payments to numerous recipients, including merchants, service providers, or marketplaces. In addition to offering improved security features including fraud detection and regulatory compliance, it facilitates worldwide transactions and a variety of payment options. By offering real-time monitoring, transaction tracking, and reporting, these gateways enhance cash flow and transparency. Nevertheless, they need intricate integration, could result in extra transaction costs, and present difficulties with KYC/AML, tax reporting, and payout flexibility. They provide substantial advantages for companies handling numerous payments and international transactions, notwithstanding these difficulties.

Faqs

Payment gateways: what are they?

Online payments are processed via a payment gateway, which also securely transfers cardholder information between the parties involved in the transaction.

Why is it crucial to have multiple gateways?

By providing customers with options, many online payment gateways can boost transaction processing success rates. You have other options if one of your payment gateways is having trouble or isn’t working well. Having several gateways fits into a worldwide strategy because they offer diverse currencies and payment methods. Furthermore, some clients will just favor one gateway over another, for example, if they already have an account there (e.g., Google Pay, PayPal).

How can I choose a gateway for payments?

When choosing a payment gateway, there are numerous things to take into account, such as price, acceptable currencies, accepted payment methods, and operating nations. Check out these four payment gateway insider secrets.

Is a payment gateway required?

Fraudsters can readily obtain client card information in the absence of a payment gateway during the online payment procedure. Your company may be vulnerable to chargebacks and fraud if it is compromised.

How is the customer data protected by payment gateways?

Payment gateways use data encryption to safeguard sensitive payment information. The gateway adheres to a number of stringent data security protocols that are outlined in the PCI-DSS compliance. Payment gateways also employ various security methods, such as 3DS2 and tokenization.

Which industries benefit most from multi-split payment gateways?

- Marketplaces (e.g., eCommerce platforms).

- Subscription services.

- Service-based businesses.

- Freelancers and gig platforms.

- Mobile apps and digital products.

What are the challenges of using multi-split payment gateways?

- Technical complexity during integration.

- Additional transaction fees for splitting payments.

- Dependency on third-party systems.

- Ensuring compliance with tax and legal regulations.

What factors should I consider when choosing a multi-split payment gateway?

- Supported currencies and payment methods.

- Transaction fees and payout schedules.

- Integration complexity.

- Security and compliance features.

- Customer support and reporting capabilities.

How do these gateways handle compliance and security?

Multi-split payment gateways implement KYC/AML checks, encrypt data, and adhere to PCI-DSS compliance standards. They also offer fraud detection tools and detailed transaction reporting for regulatory transparency.