In the dynamic digital economy, companies are always looking for how they can make transactions easier, improve customer experience, and increase revenue. One such technology that is changing the way companies accept payments is the payment links. Whether you are a freelancer, small business owner, or enterprise merchant, learning and employing

link payments can change your revenue streams dramatically. This guide will discuss what is a payment link, how it functions, and why it’s such a valuable tool for contemporary commerce.

What Is a Payment Link?

A payment link is a safe, sharable QR code or URL that allows customers to pay directly. It does not require the use of a website or physical payment terminal. Companies can send the links through email, SMS, social media, or any messaging service. When the customer clicks the payment link, they will be taken to a safe checkout page to finalize the transaction. This easy, convenient way is also referred to as link pay, pay to link, or link payment and is particularly ideal for home-based or mobile businesses, professionals, and anyone wishing to accept payments immediately.

What Is Link Payment and How Does It Work?

Link payment is the way payments are received via a common URL or QR code. When a company sends a business payment link, the customer simply clicks on the link, checks the amount and product/service details, and enters their payment details. Upon submission, the funds get transferred securely into the business account. This approach is based on a link payment system, which may be a part of an umbrella payment gateway or merchant service provider. Popular link payment modes are card payments, bank transfers, and digital wallets.

Advantages of Payment Links for Businesses

- Boosted Sales: With payment links online, companies can reach customers across various channels, minimizing friction during the purchase process. This ease tends to result in increased conversion rates.

- Accelerated Cash Flow: By sending payment links immediately after a sale or service, you close the order-to-payment time gap faster, enhancing your cash flow.

- No Website Necessary: You do not require an e-commerce site to begin selling. With create payment links, online payments can be securely accepted even by companies that do not have websites.

- Secure Payments: Providers employ encryption and compliance measures such as PCI DSS to make link payment secure for both customers and businesses.

- Flexibility Across Markets: From health and education to food delivery and home services, link payments are effective and versatile across industries.

How to Create a Payment Link

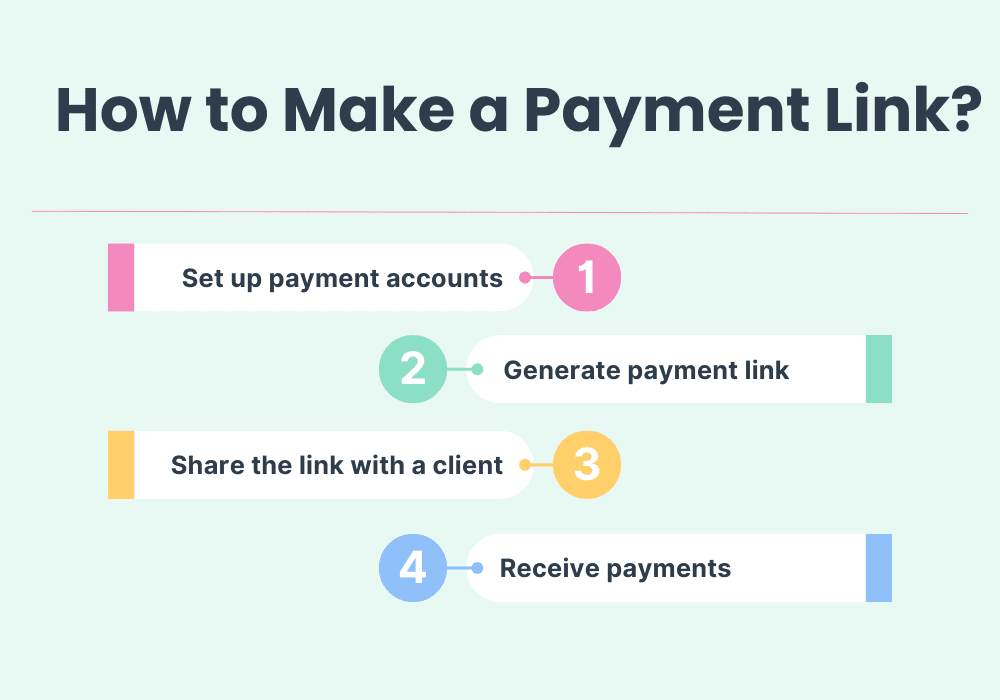

Business owners wonder, how to create payment links for their unique requirements. The best part is it’s easy. Here’s how to do it:

Choose a Payment Provider

Register with a provider who provides link payment method services (e.g., Stripe, PayPal, Razorpay, Square).

- Enter Payment Details: Enter the amount, currency, description, and optional payment expiration time.

- Create Payment Link: Tap the generate payment link or make a payment link button. The system generates a unique, followable URL.

- Share the Link: Send it through SMS, WhatsApp, email, or put it on your website or social media handles.

- Get Paid Instantly: When customers pay, you’ll receive a notification, and the funds will be deposited to your account after processing.

How to Create Payment Link for Bank Account

If you wonder, how to create payment link for bank account, the procedure is identical but includes connecting your bank account to the payment platform directly:

- Employ a payment gateway that accepts direct bank transfer.

- During setup, connect your bank account by inputting the required information and verification.

- When you generate the payment link, the backend will send the transaction directly to your account.

This process is particularly helpful for freelancers and consultants.

Use Cases of Link Payments

Retail & E-commerce: Share online payment link for one-click checkout during Instagram or Facebook sales.

Service Providers: Send payment link upon job completion for easy settlement (e.g., tutors, photographers, or plumbers).

Event Organizers: Collect registration fees with send payment links to participants through WhatsApp or email.

Subscription Services: Send recurring links payments for monthly subscriptions or memberships.

NGOs & Donations: Share create payment link through social media for easy fundraising.

Is Link Payment Safe?

Yes. If handled through trusted platforms, link payment is secure and employs encrypted SSL protocols, tokenization, and fraud detection tools. Keep your link payment system PCI DSS compliant at all times and observe best practices like:

- Do not share payment links in open forums.

- Utilize platforms that support 2-factor authentication.

- Track transactions and include link expiration dates.

Popular Link Payment Systems

- Stripe Payment Links

- Square Online Checkout

- Razorpay Payment Links

- PayPal. Me

- Google Pay Business Links

All platforms enable you to generate payment links specific to your brand, usually with brandable branding, tax configurations, and more.

Why Use Online Payment Links Today?

In the fast-paced, mobile-first world, online payment links provide a frictionless way for customers to pay and for businesses to collect revenue. Whether you’re collecting tips, charging for services, or selling products, the ability to generate payment link on demand is invaluable.

Final Thoughts

Overall, payment links are a business game-changer for companies of all sizes. From usability to security and customer experience, implementing a link payment solution can drastically improve how your business generates revenue. How simple it is to set up payment link makes it easy even for non-tech users. Now is the ideal time to begin utilizing link payments to widen your payment channels, gain more customers, and drive more revenue.

FAQs

What is a payment link?

A payment link is an online URL through which customers can make payments without a site or app.

How to create a payment link?

Utilize a payment provider’s dashboard and input the payment information and press generate payment link.

How can I make a payment link for bank account?

Yes, it is possible to make payment link for bank account by connecting bank directly.

Is link payment secure?

Yes, established platforms implement encryption and fraud detection to make link payment secure.

Which businesses can use link payments?

Any business, ranging from freelancers to big corporations, can benefit from online payment links.