With the constantly changing commerce environment, retail payment processing is now the all-important infrastructure supporting the retail motor. Whether your business is a boutique, supermarket chain, or omnichannel e-commerce, a quick, secure, and dependable retail payments system can greatly impact your customer satisfaction, top-line growth, and operational performance.

This article delves deep into the world of retail payment solutions, covering important concepts, technologies, trends, and best practices to enable retailers to make knowledgeable decisions when selecting and optimizing their retail processing infrastructure.

What Is Retail Payment Processing?

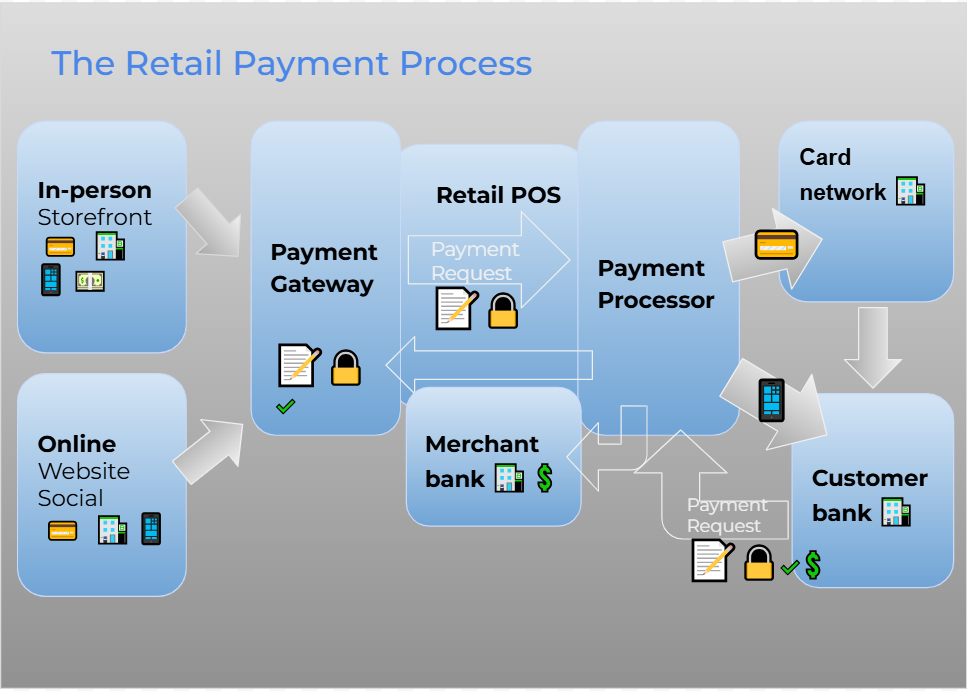

Essentially, retail payment processing involves a merchant accepting customer payments through some systems and third-party services. It represents a series of steps ranging from initiating payments to authorizing, authenticating, clearing, and settling carried out in real-time or near-real-time.

The ecosystem consists of:

- Retail payment processors

- Retail payment systems

- Retail payment methods

- Financial institutions (issuing and acquiring banks)

- Card networks (Visa, Mastercard, etc.)

- Payment gateways and software solutions

A retail payment processor facilitates the secure transfer of the customer’s payment from their bank account or card to the merchant’s account.

Types of Retail Payment Methods

Technology has brought into existence a multitude of retail payment methods, each suited to varied tastes and purposes. Familiarity with these retail payment modes is essential to provide a smooth checkout experience.

- Credit and Debit Cards: The most prevalent retail payment form, credit and debit card transactions represent a considerable percentage of retail transactions. Merchants need to be compatible with EMV chip cards and provide contactless tap-to-pay capabilities for the current customer expectations.

- Mobile Payments: Mobile wallets such as Apple Pay, Google Pay, and Samsung Pay are transforming the way payments are made in retail. These wallets utilize NFC (Near-Field Communication) to enable fast and secure payments. They also support loyalty programs and biometric authentication.

- Cash: Even with digital supremacy, cash is still a popular retail payment method in most demographics and geographies. It’s immediate, doesn’t have processing fees, and is still a favorite for small purchases.

- Buy Now, Pay Later (BNPL): BNPL is an emerging retail payment solution in industries such as fashion and electronics. Retailers such as Klarna, Afterpay, and Affirm enable customers to pay in installments over a few weeks or months, usually interest-free.

- Bank Transfers / ACH: Bank transfers are utilized in higher-value transactions, especially online. ACH (Automated Clearing House) transfers are secure and low-cost, making them a solid payment solutions retail strategy for eCommerce websites.

- Gift Cards and Store Credit: Gift cards are a great retail payment solution for generating loyalty and upsizing the basket. They’re also widely used in returns, refunds, and promotions.

Why Retailers Require Contemporary Payment Solutions

Having modern payment solutions in retail is not merely about accepting more cards or installing a mobile terminal. It’s about empowering an experience that aligns with customer expectations while making backend systems work seamlessly.

- Critical advantages of innovative retail payment solutions are:

- Faster Checkouts: Shortening line time and deserted carts.

- Multi-channel Support: Integrated retail payment systems at physical and digital channels.

- Fraud Prevention: Internal capabilities to catch and stop doubtful transactions.

- Real-Time Analytics: Access to information about payment trends, busy times, and buyer habits.

- Less Operational Expenses: Automation and optimization reduce transaction costs and labor.

Key Components of a Retail Payment System

A contemporary retail payment system consists of various technologies and services that provide smooth, secure, and scalable performance. Let’s discuss each component:

- Point-of-Sale (POS) Systems: The retail payment processing frontline, POS terminals are where customers engage at checkout. Integrated POS systems link inventory, loyalty schemes, and sales information with retail payment processors for efficient operations.

- Payment Gateway: Gateway grabs and encrypts payment information and sends it on to the retail payment processor. It’s imperative for online, as well as omnichannel, retailers and has to be PCI-compliant.

- Payment Processor: The retail payment processor enables liaison between the card networks, merchant’s bank, and issuing bank. Selecting a trustworthy processor affects speed, cost, as well as satisfaction of customers.

- Acquiring Bank: This is the bank that receives the money on behalf of the retailer. It also services the merchant’s account, in sync with the processor.

- Fraud Prevention Tools: They safeguard both consumer and retailer against data breaches, chargebacks, and identity theft. AI-based fraud detection is fast becoming a part of every retail payment system.

How to Choose the Best Retail Payment Processor

With several vendors making a play in the market, choosing the ideal retail payment processor may be daunting. Here’s what to look for:

- Transaction Fees: Flat rates or interchange-plus pricing.

- Hardware Compatibility: Does it work with your POS system?

- Security Features: Tokenization, end-to-end encryption, PCI-DSS compliance.

- Support for Multiple Payment Types: Particularly for new retail payment methods like BNPL or crypto.

- Customer Service: 24/7 support during outages or disputes.

- Scalability: Will the solution scale with your business?

Cost Factors in Retail Payment Processing

Although taking more retail payment types enhances conversion, it adds complexity and expense. Typical charges are:

- Transaction fees (fixed + percentage)

- Monthly service fees

- Chargeback fees

- Hardware and software expenses

- Cross-border and foreign exchange fees

- To control costs:

- Compare several retail payment processors

- Negotiate improved rates on transaction volume

- Employ analytics to monitor fees and streamline retail payment systems

Security and Compliance

Security is not negotiable in retail payment processing. Breaches can lead to financial losses, lawsuits, and damaged reputation.

Key security measures are:

- PCI-DSS Compliance: Mandatory for any business that accepts card payments.

- End-to-End Encryption: Secure data throughout the transaction.

- Tokenization: Substitutes sensitive data with secure tokens.

- Fraud Detection Systems: Scans real-time activity for red flags. Retailers have to remain current on changing security standards to maintain their retail payments system secure from attacks.

Integration with Other Retail Systems

Some of the greatest strengths of contemporary retail payment solutions include their integration with other essential systems such as:

- Inventory control

- Customer relationship management (CRM)

- Enterprise resource planning (ERP)

- E-commerce sites

- Marketing and rewards schemes

A unified retail payments solution streamlines backend processes, minimizes mistakes, and improves decision-making with centralized information.

Trends Defining the Future of Retail Payments

The future of retail payments is changing fast. Some of the trends defining its future include:

- Omnichannel Payments: Shoppers want to pay in-store, online, and on their mobile devices with the same retail payment methods. Solutions have to deliver unified commerce experiences.

- Predictive Analytics and AI: AI makes fraud detection stronger and gives customers customized experiences by examining retail payments in real-time.

- Contactless and Voice Payments: With advances in hardware, contactless cards and voice assistants are becoming popular retail payment modes.

- Subscription and Recurring Billing: For services such as meal kits or product-of-the-month clubs, retail payment processors are adapting to accommodate recurring payments seamlessly.

- Blockchain and Crypto: Although still in its infancy, crypto is a new type of retail payment that can be decentralized and has low processing fees.

Issues with Retail Payment Systems

In spite of the progress made, issues still exist with retail payment processing:

- Disputes and Chargebacks on Payments

- Complexity in Integration

- System Downtime

- Excessive Processing Fees

- Adapting to Regulatory Changes

To solve these, retailers must collaborate with seasoned retail payment solution providers that provide continuous support and updates.

Case Study: Retail Success through Smart Payment Systems

Suppose a mid-sized fashion retailer replaced a legacy POS system with a cloud-based retail payment system. By facilitating contactless payments, loyalty rewards integration, and real-time inventory updates, the retailer:

- Shortened checkout time by 30%

- Improved customer retention by 20%

- Realized 15% savings on a monthly basis in processing fees by changing retail payment processors

This example demonstrates the value of flexible, technology-based payment solutions that retail companies can take advantage of now.

Conclusion

In order to thrive in the highly competitive retail environment, merchants should prioritize retail payment processing. Providing a broad selection of retail payment options, investing in secure retail payment systems, and choosing the appropriate retail payment processor can make operations more efficient and increase customer satisfaction. By bringing retail payments in line with consumer behavior and technology innovation, retailers not only future-proof but also build more engaging and lucrative customer journeys. Whether building a new store or refining a current operation, remember: an effective, secure, and flexible retail payments system is no longer a choice no, it’s a must.

FAQs

What is retail payment processing?

Retail payment processing is the mechanism that retailers utilize to process customer payments. It entails capturing the payment information, validating it, approving the transaction, and remitting funds from the customer’s bank account to the retailer’s bank account.

What are the most popular retail payment methods?

The most popular retail payment methods are:

- Credit and debit cards

- Mobile wallets (e.g., Apple Pay, Google Pay)

- Cash

- Bank transfers

- Buy Now, Pay Later (BNPL)

- Gift cards and store credit

What is a retail payment processor?

A retail payment processor is a service provider that facilitates the communication between the merchant, the card network, and the customer’s bank to make a payment transaction secure and efficient.

How do I select the best payment solutions for retail?

When selecting payment solutions for retail, take into account:

- Accepted retail payment types

- Transaction fees

- Integration with POS and eCommerce platforms

- Security and compliance features

- Quality of customer support

- Scalability and adaptability

Are there separate retail payment systems for online and in-store transactions?

Yes. Retail payment systems can be designed for online shops, physical shops, or both. Omnichannel retail payment solutions consolidate all channels to deliver a seamless experience.

What is the difference between a payment gateway and a payment processor in retail?

- A payment gateway securely transmits transaction data from the point-of-sale or online checkout to the processor.

- A retail payment processor handles the approval, clearing, and settlement of the payment.

Is cash still a relevant retail payment option?

Yes, cash remains a widely used retail payment option, especially in certain regions, age groups, and smaller purchase scenarios. However, digital methods are becoming increasingly dominant.

How can retailers reduce payment processing fees?

Retailers can:

- Compare several retail payment processor rates

- Negotiate discounted fees by transaction volume

- Charge flat-rate or interchange-plus prices

- Reduce chargebacks with anti-fraud features

What security standards do retail payment systems have to meet?

All retail payment systems need to follow PCI-DSS standards, allow end-to-end encryption, and frequently utilize tokenization to guard cardholder information.

Can a single retail payment solution process both online and in-store payments?

Yes, most contemporary retail payment products are omnichannel, with unified systems for processing both online and in-store payments seamlessly.