With growing interdependence in Europe today, cross-border money transfer has become easier, quicker, and cheaper. One of the key drivers of this hassle-free payment experience is the SEPA Transfers Explained payment system. Whether you are a private individual who is making a money transfer to a foreign friend or a corporate entity making payments to various European countries,

how SEPA payments operate helps you make wiser financial choices. This article analyzes what are SEPA payments, how to make use of them, and why they matter so much for the European economy.

What is SEPA?

To know Single Euro Payments Area, you must be aware of the general objective of SEPA. The Single Euro Payments Area (SEPA) is a European Union initiative to make euro-denominated bank transfers less complicated. It enables consumers, businesses, and public administrations to make cashless transactions under the same set of basic conditions throughout Europe. SEPA was introduced in 2008 and unifies bank transfers to be just as simple and inexpensive as domestic payments. The SEPA payment scheme comprises 36 nations: all of the EU member states and some non-EU states such as Norway, Iceland, Liechtenstein, Switzerland, and the UK (temporarily).

What Are SEPA Payments?

So what are SEPA payments, then? SEPA payments are euro-denominated transactions between banks based in SEPA countries. They can be credit transfers, direct debits, and card payments. They are simplified to minimize processing time and fee, irrespective of which SEPA country the sender or recipient is based.

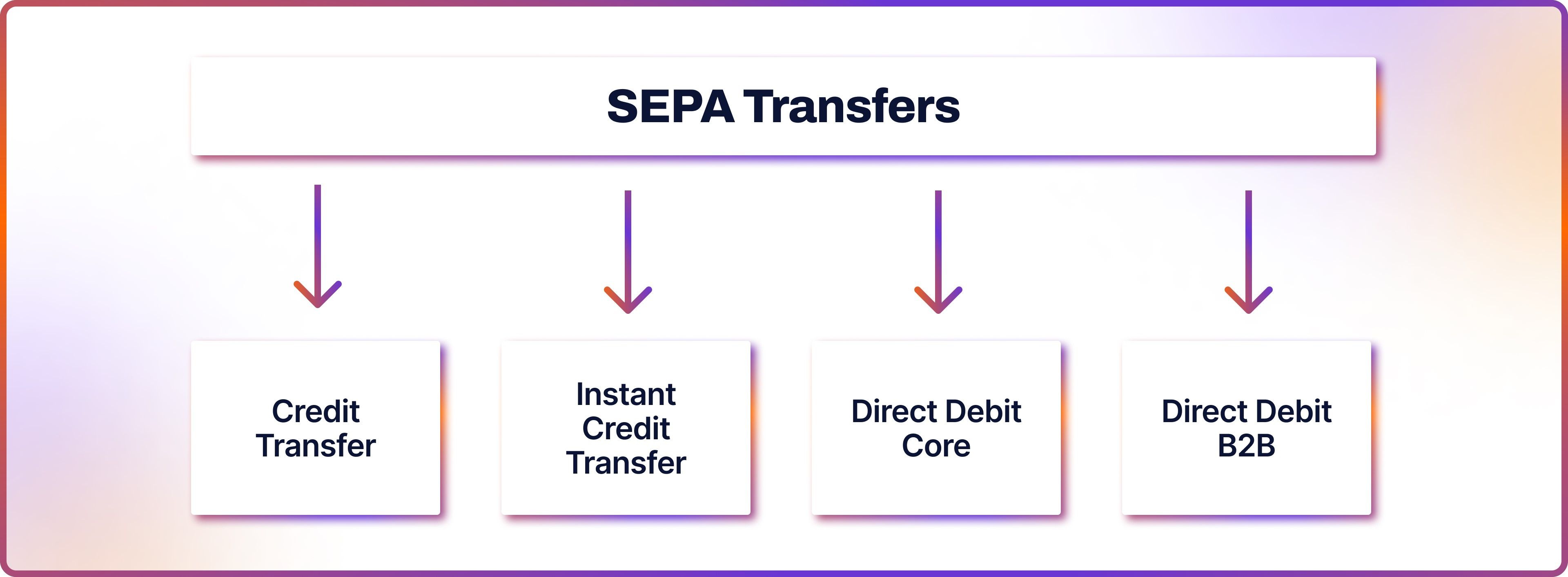

There are three basic types of SEPA payments:

- SEPA Credit Transfer (SCT): For single euro payments between accounts.

- SEPA Direct Debit (SDD): For regular euro-denominated payments such as utility bills or subscriptions.

- SEPA Instant Credit Transfer (SCT Inst): Enables near-instant payment in seconds, 24/7.

All three have a common structure based on the International Bank Account Number (IBAN) and the Bank Identifier Code (BIC).

How to Make a SEPA Payment?

If you’re curious about how to send a SEPA payment, it’s easy. Most online banking systems and fintech apps support easy digital payment SEPA transfers. Here’s a quick guide on how to make a SEPA transfer:

- Log in to your bank account through online or mobile banking.

- Select the option to create a new payment or transfer.

- Select SEPA Credit Transfer if necessary (some systems do this by default).

- Enter the recipient’s IBAN (and BIC if required).

- Add the payment amount in euros.

- Include a reference or payment note (optional but helpful).

- Confirm and authorize the payment using your bank’s security verification method.

The transaction typically settles within one business day for standard credit transfers, or instantly if using SEPA Instant Credit Transfer.

SEPA Payment System Benefits

The SEPA payment system has a number of benefits that contribute to its popularity for cross-border payments within Europe:

- Efficiency: Transfers are quick, generally within a day.

- Low cost: Charges are typically the same as for domestic euro transfers.

- Security: Standardized systems and processes build confidence and lower fraud.

- Transparency: All fees and timeframes are transparent and regulated. Companies gain a lot from this system, as it enables them to organize their finances in several nations.

How to Make a SEPA Transfers Explained from Outside Europe?

Most individuals wonder how to initiate a SEPA transfer if they are located outside the SEPA area. Although the SEPA system is particularly for transactions within Europe, non-European payment services and banks may initiate SEPA transfers through correspondent banks or collaboration with European financial institutions. Fintech services like Wise, Revolut, and Payoneer also support SEPA transfer features for clients outside Europe.

Common Usage of SEPA Payments

SEPA payments are typically utilized for:

- Payment of EU-based contractors or freelancers.

- Payment to family or relatives in Europe.

- Making online payments from European websites.

- Receiving wages or pension from EU employers.

Whether for personal or corporate use, these payments are now quicker and more secure due to the SEPA payment system.

SEPA vs SWIFT Transfers

It’s necessary to make a distinction between SEPA payment and SWIFT payments. Whereas SEPA transfers are restricted to euro transactions within the SEPA area, SWIFT allows international payments in multiple currencies across the world. SWIFT transfers tend to be longer in duration and costlier compared to SEPA. Hence, SEPA is a preferred method for euro-zone transfers.

Final Thoughts

Understanding what is Single Euro Payments Area and how SEPA transfers function can simplify your cross-border financial activities. Whether you’re trying to learn how to make a SEPA payment for personal reasons or need to know how to make a SEPA transfer for your business, the process is designed to be user-friendly and efficient. The SEPA payment system is one of the pillars of contemporary European banking, developing closer financial integration and economic cooperation in the continent. With more financial institutions embracing and propagating SEPA payments, the future of euro-zone money transfers appears more streamlined and accessible than ever before. If you’re operating with euros and in or working with European countries, it is crucial to master SEPA payments. Knowing what are SEPA payment and how to make a SEPA transfer means your money will travel fast, securely, and with low costs within the Single Euro Payments Area.

FAQs

What are SEPA payments?

SEPA payments are bank transfers within the Single Euro Payments Area that are denominated in euros. They are harmonized and permit quick, secure, and inexpensive exchanges between SEPA-participating nations.

What is Single Euro Payments Area?

Single Euro Payments Area (SEPA) is an EU program that streamlines cross-border payments of euros. It allows individuals and businesses to make euro payments under the same terms and conditions in 36 participating EU countries.

Who are the eligible users of the SEPA payment system?

Anyone with a euro account in a SEPA-participating nation can be an eligible user of the SEPA payment system. This covers individuals, businesses, as well as institutions.

How to make a SEPA payment?

To send a SEPA payment:

- Log into your online banking service.

- Choose “SEPA transfer” or its equivalent.

- Input the IBAN and BIC of the recipient (if necessary).

- Enter the amount in euros.

- Authorise and confirm the transfer.

How do I make a SEPA transfer if I am based outside Europe?

You can still make a SEPA transfer from outside Europe via international banks or fintech services that facilitate euro payments through European partner banks. Consult your provider to see if they provide SEPA services.

Are SEPA payments instant?

Some SEPA payment are instant if processed through SEPA Instant Credit Transfer (SCT Inst), which settles funds in under 10 seconds, 24/7. Otherwise, standard transfers usually take 1 business day.

Is there a fee for SEPA payments?

In most cases, SEPA payment are free or charged the same as a domestic euro transfer. However, always check with your bank, especially if you’re using a non-Eurozone account.

Do I have the ability to make SEPA payment in non-euro currencies?

No, SEPA payment have to be made in euros. Trying to send money in a non-euro currency will not classify as a SEPA transfer.

What do I need to make a SEPA payment?

You require:

- Recipient’s IBAN

- BIC (optional based on the country)

- Payment amount in euros

- Reference or payment description (optional)

Which countries are included in the SEPA payment system?

The SEPA payment system encompasses:

- All 27 EU member states

- Iceland

- Liechtenstein

- Norway

- Switzerland

- Monaco

- San Marino

- Andorra

- Vatican City

- United Kingdom (still included under certain terms)