In the rapidly digitizing market of today, United States companies are not only competing on service and product quality but also on the efficiency and flexibility of their payment processes. Consumers today are demanding frictionless, fast, and secure transactions everywhere—online, in-app, or point-of-sale.

This has further raised the need for more sophisticated payments orchestration methods. This piece is a thorough overview of payment orchestration (USA), Where American businesses benefit from payments orchestration platforms, how the leading providers of payment orchestration deliver, and the ways in which the growing market of payment orchestration platforms is changing digital business.

Defining Payment Orchestration and Its Value

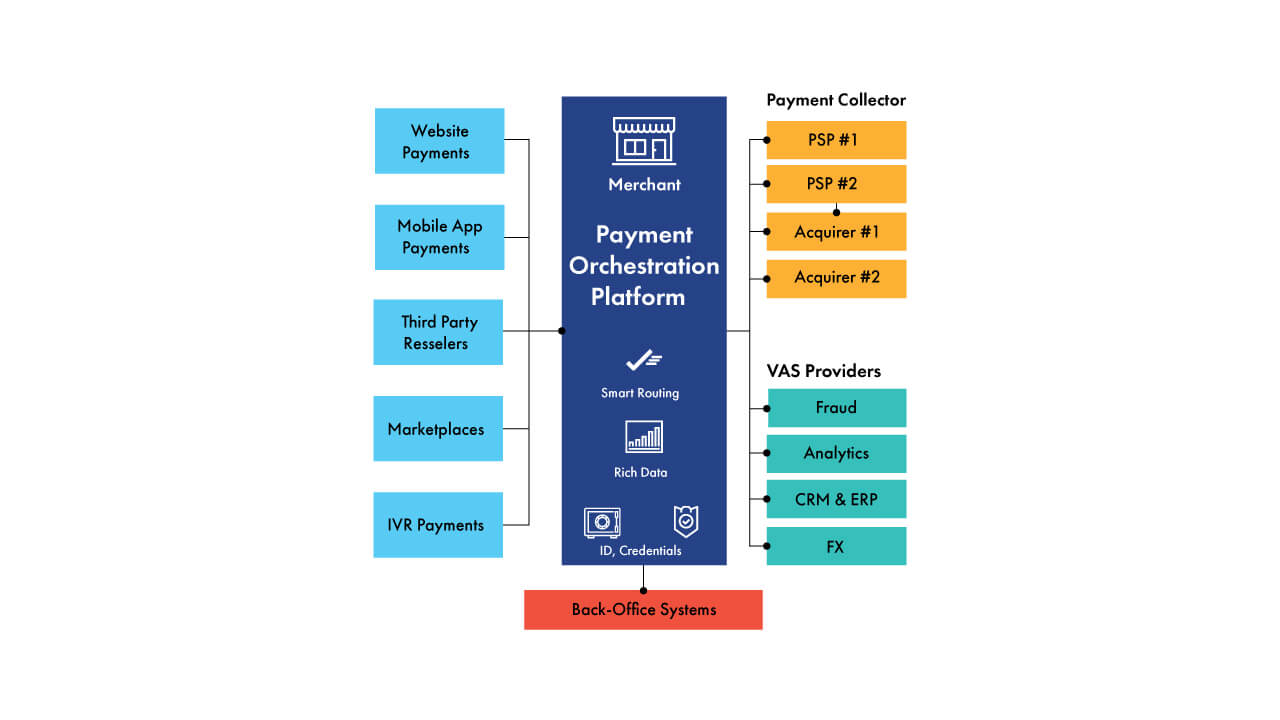

What is payment orchestration? It refers to the routing and processing of digital payments in a smart, centralized platform that combines several payment service providers (PSPs), acquirers, gateways, and fraud protection services. The aim is to obtain the optimal choice for each transaction in a dynamic manner, thus reducing the costs, and the approval rates. On a broader scale, what is payments orchestration? It’s an end-to-end platform that includes authorization, tokenization, fraud prevention, transaction routing, and settlement for all the channels and modes. Instead of having a single payment gateway, businesses utilize a payment orchestration layer to combine many different services, make automated decisions, and gain better management of their payments landscape.

Why Payments Orchestration is Important in the U.S. ?

The U.S. payment landscape is huge and complex. It has thousands of PSPs, banks, card networks, and alternative payment methods, making it difficult to navigate the ecosystem. Some of the reasons why companies operating in the United States need payments orchestration are as follows:

Fragmentation: Having numerous payment channels (ACH, debit, credit, PayPal, Apple Pay, etc.) requires centralized management.

Large Volume of Transactions: Online retailers, in particular, process millions of transactions daily. Orchestration optimizes every single one.

Risk of Fraud: U.S. companies are frequently victims of fraud. Orchestration integrates fraud tools efficiently for greater security.

Global Expansion: U.S. companies selling internationally need flexible routing and currency processing, enabled by global payment orchestration solutions.

Payments Orchestration Platform Functionality

A payments orchestration platform is a central platform that consolidates several PSPs, acquirers, fraud solutions, tokenization services, and other payment components. These platforms offer a layer of intelligence that allows merchants to:

- Automate routing decisions based on location, payment method, or cost.

- Retry failed transactions through alternative routes or fallback options.

- Tokenize card data securely for recurring billing and PCI compliance.

- Access centralized analytics across all payment channels and providers.

- Install alternative payment methods on the fly without extra code.

Top payment orchestration platforms are built with modularity, no-code or low-code integration and management capabilities.

High-Performing Payment Orchestrators: Key Features

Payment orchestrators today must provide more than routing alone they come with the architecture for real-time optimization and end-to-end visibility. Typical core features are:

- Smart Routing: Transactions are directed to the PSP or acquirer most likely to accept them successfully. Routing is based on country, card type, time of day, or cost.

- Redundancy and Failover: In case a provider goes down or declines a transaction, the system directs to a backup in real-time, without losing revenue.

- Tokenization: Customer card details are securely stored and processed across platforms, reducing PCI DSS scope and enabling frictionless repeat purchases.

- Fraud Prevention: Integration with several fraud tools (e.g., 3D Secure, behavioral analytics, machine learning models) reduces chargebacks and optimizes conversion rates.

- Data Normalization: Transaction data from all sources is brought together, making analysis of performance, trend analysis, and payment reconciliation easier.

- Modular Integration: Firms can modify or add PSPs without impacting existing infrastructure giving flexibility and vendor independence.

Learning about the Payment Orchestration Layer

The payment orchestration layer is the middleware that hides the complexity of the payment processing. Instead of integrating to each PSP or tool directly, the merchant integrates to the payment orchestration layer, which then takes care of all downstream interactions. This solution gives the merchant full control over the customer experience from settlement to checkout and allows for rapid rollouts of new features, providers, or geographies. In the US, where time to market is critical, this architecture provides the competitive edge.

Advantages of Payment Orchestration (USA)

- Payment Performance Optimized: By using intelligent routing and failover, orchestration payments increase authorization rates and deliver greater success at checkout.

- Cost Reduction: By dynamically selecting the least expensive PSP or acquirer, businesses reduce processing fees especially relevant in the U.S., where card interchange fees are high.

- Scalability: As volume grows, orchestration simplifies scaling by adding providers or expanding into new geographies without cumbersome re-engineering.

- Compliance and Security: With built-in capabilities for PCI DSS, GDPR, and local U.S. data protection regulations, orchestration offers secure and compliant processing.

- Enhanced Customer Experience: Faster transactions, fewer declines, and more payment options translate to better user experiences and higher conversion rates.

Industries Applying Orchestration Payments

- E-commerce: Dynamic routing improves success rates, tokenization and retry logic expand subscription models.

- Travel and Hospitality: Accommodates multiple currencies and nations, required for international bookings and hotel payments.

- Healthcare: Enables payments and complies with HIPAA-based data security.

- Gaming and Streaming: Allows microtransactions and real-time payments with low latency.

- B2B and SaaS: Offers recurring billing capabilities, improved analytics, and customized workflows. Across sectors, orchestration payments align payment infrastructure with broader business goals.

Top U.S.-Based Payment Orchestration Providers

The United States boasts many top-notch payment orchestration providers offering scalable, reliable, and innovative platforms:

- Stripe: While not strictly a pure orchestrator, Stripe offers capabilities like smart routing and fraud protection, commonly used in orchestration processes.

- Payoneer: Provides a cross-border orchestration platform for marketplace payments and international currency management.

- CellPoint Digital: Well-known for airline and travel payment orchestration, it’s expanding into retail and e-commerce in the U.S.

- Primer: Provides an entirely modular orchestration solution with visual workflow automation tools appropriate for U.S. startups and mid-cap companies.

- Apexx Global: Caps PSPs and acquirers under one API and is finding traction with U.S. e-commerce merchants. These payment orchestration companies compete on uptime, speedier onboarding, greater integrations, and support for compliance.

The Growth of the Payment Orchestration Platform Market

The payment orchestration platform market is booming. The international market will hit more than $5 billion by 2030, industry experts claim, headed by North America due to high penetration of edge commerce and merchant acumen.

Top trends in driving the U.S. share of this market are:

- Booming count of BNPL providers

- Increased app commerce and mobile shopping

- Growth in subscription business

- Requires real-time reporting and analysis needs

- Requirement of vendor independence

US retailers are particularly concerned about platforms which will integrate into existing technology stacks like Salesforce, Shopify, Magento, and QuickBooks easily.

Obstacles and Things to Take into Consideration

It is not a walkover though, getting payments orchestration live is subject to challenges:

- Start-up Costs: While in the long term the costs make sense, there’s up-front investment in human talent and tech.

- Vendor Management: It takes strategic planning and negotiation to manage multiple PSPs.

- Regulatory Complexity: U.S. businesses must navigate both federal and state-level payment regulation.

- Data Governance: Tokenized data management across systems requires strict controls. With the proper payment orchestration provider, such risks can be prevented through pre-integrated tools, 24/7 support, and ongoing updates for compliance.

Future Perspective for Global Payment Orchestration

As borders blur in the age of digital, global payment orchestration will become a critical pillar of support for growth. U.S. platforms are now offering multi-currency, multi-language, and geo-optimized solutions to facilitate domestic merchants’ access to international markets. Global payment orchestration will eventually go beyond routing to include dynamic FX conversion, real-time payment methods (like UPI in India), and even blockchain-based settlement processes.

Conclusion

Payment orchestration (USA) is not a trend it is a business imperative for companies that aspire to succeed in an accelerating, global digital economy. Through investments in payments orchestration platforms, U.S. companies can unify fragmented payment systems, reduce costs, increase security, and deliver frictionless customer experiences. As the payment orchestration platform market grows bigger, expect greater uptake, innovation, and enhanced functionality that will make payment orchestrators indispensable to the American merchant market. Whether you’re a business building out or an enterprise optimizing cross-border payments, the right payment orchestration layer can catapult your business to the next level.

FAQs

What is payments orchestration?

Payments orchestration is the consolidation and management of multiple payment service providers, gateways, acquirers, and fraud solutions onto a single intelligent platform. It enables merchants to simplify payments, increase transaction success rates, and reduce processing fees.

What is payments orchestration and how does it differ from traditional payment arrangements?

Orchestration of payments is an end-to-end infrastructure that optimizes the flow of transactions from authorization to settlement. As opposed to the traditional environments grounded on one gateway or provider, orchestration allows businesses to route payments dynamically across various providers in return for greater uptime, flexibility, and performance.

What is a payments orchestration platform?

A payments orchestration platform acts as a shared layer in between your payment system and numerous payment service providers. It offers smart transaction routing, retry when payments fail, tokenization, and fraud protection through one single interface.

Who are the top payments orchestration vendors in the USA?

Top U.S. payments orchestration vendors include Stripe, Payoneer, Primer, CellPoint Digital, and Apexx Global. These payments orchestration vendors offer strong solutions for intelligent routing, cross-border payments, and real-time analytics.

How does a payments orchestration layer help with compliance?

The orchestration payment layer provides tokenization, PCI DSS compliance, and seamless integration with fraud solutions. It reduces your PCI scope and protects sensitive information to be processed securely through all payment methods.

What are the benefits of using orchestration payments in e-commerce?

Orchestration payments help e-commerce businesses reduce failed transactions, enhance authorization rates, and offer consumers more payment options. This increases conversions, cart abandonment minimization, and lower processing fees.

In what ways does global payments orchestration enable cross-border trade?

Global payments orchestration enables businesses to accept payments in multiple currencies, send transactions to local PSPs, and comply with local regulations on one platform. This is required by U.S. businesses that are expanding globally.

Are payments orchestration platforms secure?

Yes. Top payments orchestration platforms prioritize security by providing encryption, tokenization, and native fraud protection. They also comply with top standards such as PCI DSS, GDPR, and U.S. data privacy regulations.

Is the market for payments orchestration platforms growing?

Yes. The payments orchestration platform market is developing fast, especially in the United States, because there is a demand for vendor-agnostic, scalable, and intelligent payment systems to support domestic as well as international trade.

How do I choose the right payments orchestration provider?

When choosing a payments orchestration provider, consider the following:

- Number of PSPs and acquirers supported

- Integration options (API, no-code, plugins)

- Smart routing and failover features

- International coverage

- Fraud and compliance features

- Support and pricing model